You are currently browsing the monthly archive for August 2010.

A few days ago Bryan Caplan wondered why economists question whether bringing someone into existence makes them better off, and I had some objections. Bryan has offered up a useful response, in which I think he has inadvertently answered his own question.

He responds to two of my challenges, in which I broadly claimed that if he were right, it would be a moral imperative which would trump all others to bring as many people into existence as possible, which seemed to violate common sense morality. He agrees that this is a bullet to bite for strict utilitarians, but adherents to other moral positions can rationalize not having to behave with an observation that begins “People who actually exist count a lot more than people who could exist but don’t.” This, however, answers the question he asked in the first place, which was:

If someone gives another person the gift of life, however, I’ve noticed that many economists suddenly become agnostic. $100? Definitely an improvement. Being alive? Meh.

It’s hard to see the logic. Why would a minor gift of cash be a clear-cut gain, but a massive gift of human capital be a question mark?

Understanding that the cash gift makes someone better off requires nothing more than strict utilitarianism, the mode of analysis economists are trained in. The gift of life however requires something more than strict utilitarianism, and requires some other moral position to justify it. Furthermore, it’s hard to think of a reasonable moral position according to which giving someone $100 does not make them better, whereas it is not so hard to imagine reasonable moral positions according to which the gift of life does not make someone better off. One is clear-cut and requires the usual tools of economic analysis, the other is not and requires appealing to other moral positions.

Elsewhere, and speaking of bullet biting utilitarians, Robin Hanson outlines an economic analysis of which creatures should exist and which shouldn’t. But I think Robin has some big unspoken assumptions in his analysis. The general problem is we don’t know the preferences of the non-existent. Here is how Robin broadly describes how the analysis of which creatures should exist should be done:

Economically, creature X should exist if it wants to exist and it can pay for itself. That is, in a supply and demand world, if our only choice is whether X should exist, then an X that wants to exist should actually exist if its lifespan cost of resources used (including paying for any net externalities) is no more than the value it gives by working for others.

The problem is that we don’t know the preferences of the non-existent, and so we don’t know Robin’s first requirement: whether creature X wants to exist. Not only that, but according to Robin’s efficiency criteria you have to know whether they prefer an existence conditional on that existence includes paying their costs, and not just existing as a freeloader. You could argue that we could poll the existing and see if they would have preferred to never exist, but we don’t know whether the preferences of the non-existent have any relationship at all to the existing. In addition, for many creatures we have no way to do even this post-existence polling. How do you understand a dogs preferences for existing versus never existing? And remember, showing a preference for continuing to exist over ceasing to existing is not the same as preferring to existing over never existing.

The problem with both of their analysis is the preferences for existing versus never existing are facts simply knowable through economic analysis, and must be brought from somewhere else. That is why, contra Bryan, I don’t think the value of the gift of life is not clear-cut to economists as the value of a $100 gift, and contra Robin, I don’t think knowing which creatures should exist is amenable to cost-benefit analysis.

I should add that, probabilistically, by simultaneously disagreeing with Robin Hanson and Bryan Caplan, I recognize I am likely wrong. So if I were to bet on these propositions, I would bet against them.

Via Denis Dutton, Camille Paglia offers a criticism of todays college education and appeal to a more job centered approach focused on trades:

Jobs, and the preparation of students for them, should be front and center in the thinking of educators. The idea that college is a contemplative realm of humanistic inquiry, removed from vulgar material needs, is nonsense. The humanities have been gutted by four decades of pretentious postmodernist theory and insular identity politics. They bear little relationship to the liberal arts of broad perspective and profound erudition that I was lucky enough to experience in college in the 1960s.

I have to say I am drawn into argument by her criticism of the humanities and their ills, e.g. “pretentious postmodernist theory and insular identity politics”, and any suggestion that begins with gutting this from the higher education system will catch my ear. However, I don’t know how much of a solution she has offered.

She wants us to “revalorize the trades”, and make sure that “every four-year college or university should forge a reciprocal relationship with regional trade schools”. I agree these are good things, but ultimately the problem lies with the incentives and constraints these institutions face, not with mission statements or relationships.

Until we know exactly why it is that universities aren’t already operating with an “obligation to think in practical terms about the destinies of their charges” we won’t know how to make them be better. Surely parents and students desires and freedom of choice should incentivize them to be effective already. I don’t think imploring them to be different nor a school’s acceptance of a new mission to do so will suffice. I believe the problem is deeper than administrators and professors knowing how to be a good university.

In the interesting exchange between Will Wilkinson and Matt Steinglass on Democracy in America, Matt writes

Through the 1990s and early 2000s,Congress progressively raised targets it set for the GSEs to securitise loans coming from low-income neighborhoods. To the extent that I understand what Mr. Rajan is talking about, I think he may be talking about this. Mr. Jaffee argues that it wasn’t relevant, because the GSEs tended to ignore Congress’s targets, and when they did meet them it was because everyone in the world, including private securitisers, were falling over each other to buy up subprime loans, since everyone had convinced themselves they’d be profitable.

This is where everyone goes wrong.

It wasn’t that everyone had convinced themselves that subprime would be profitable. Subprime WAS massively profitable. There were subsequent losses for those who, unlike Goldman, didn’t jump ship in time. But, make no mistake, plenty of people made bank off of subprime.

Here is Lehman Stock Chart

Subprime securitization began around 2002 and took off after 2004. Lehman stock went right along with it.

People get confused here when they try to think about concepts like “fundamental value.” I will remind you again Saks Fifth Avenue does not accept fundamental value as payment. You will not be dining at the Ritz if you attempt to pay with value added. They do, however, accept cash or cash equivalents.

You do not become rich by creating fundamental value. You become rich by having a lot of cash. If you don’t get that, you completely miss the incentive structure that actually runs the world.

Sometimes, yes it is the case that there is a one-to-one correspondence between fundamental value and cash. Often, the relationship is something less than one-to-one and occasionally its inverted. However, whatever the relationship is, a rational agent will seek cash, not fundamental value – cash.

The simple fact of the matter is that people who were massively into subprime in 2002 made lots and lots of cash. You don’t need the government to explain the attraction there.

The question there is: why did they make so much money when what they were selling was junk? I argue that no one knew for sure that it was junk. I say this as someone who at the time thought it was junk but sure as shit wasn’t going to risk my life savings betting against it.

Why?

Because I didn’t KNOW it was junk. There were a lot smart guys with very sophisticated arguments that it wasn’t junk. And, they were making money.

I even said at the time that when you – as in me – argue year-after-year that a strategy can’t be profitable and year-after-year people keep making profit there is a point where you have to say to yourself: maybe there is something I just don’t get about this.

That’s where I was in late 2006, early 2007. Now soon after the tide turned and things went bad. However, I just don’t buy it from anyone who says that the run-up wasn’t pure yield chasing and that it didn’t work extremely well until the whole house of cards came down.

Incidentally, perhaps others will tell you differently, but I got the impression from the debates that I was in, that individuals who were pushing structured products really and truly believed that the world had changed. They weren’t just running a pump-and-dump. As is evidenced by the fact that they bought a lot of the stuff themselves.

Back in the day

THURSDAY, DECEMBER 13, 2007

Was There A Housing Bubble . .

or a simply a credit bubble.

This may seem like a widly pedantic inquiry. What difference, if one even exists between the two, does it make whether there was a housing bubble or just a "credit" bubble? Prices are falling and that is obvious to anyone.

I do think it makes a bit of difference, though, in thinking about how this whole thing is likely to unfold and how to prevent it again.

Some people lay the blame for this crisis at the feet of Alan Greenspan and his failure to diffuse what was obviously a growing problem. The question for me is – from a macro perspective how obvious was it?

My own take is that the current crisis has most of its seed in the structured debt boom. Housing prices started to rise early in the decade from easy money and a decline in world wide long term interest rates. To the extent that this was the whole story we wouldn’t have that serious of a problem on our hands.

Tightening monetary policy would have slowed down the rise in housing prices and we probably would have been able to pull of a soft landing. The problem is that at exactly the time monetary policy was tightening, credit standards were loosening, big time.

There was a sense, ill-placed as it may have been, that risk could be managed with far greater efficiency than ever before. And managing risk is terribly important. Had structured debt lived up to its hype it would have meant a revolutionary change for millions of Americans. It would have meant the opening of opportunities, the forgiveness of pass indiscretion and new chances which would lead to an eventual unleashing of entrepreneurial ingenuity. That, however, was not to pass.

So it turns out that people have fewer opportunities and banks are less willing to overlook imprudence. Thus, the dream home and dream opportunities that would have been yours, cannot be. This is real and it is a loss.

That’s important, because it means that the bursting of this bubble is not as William Buiter suggests, a zero-sum game. We are not simply transfering income from current homeowners back to future homeowners. We slashing the opportunity sets of millions of current and future homeowners a like. Such an adjustment will be inevitably painful in the short term and I am not sure there is effective means for preventing something of the sort from happening again.

POSTED BY KARL SMITH AT 12:45 PM

Calculated Risk tells us the key to fixing the housing market:

The key to the housing market is to absorb the excess inventory. That means more households and fewer new housing units. Luckily housing starts are very low right now, but unfortunately there is very little job growth (and therefore little new household formation).

But job growth is not the only way to get new household formation, as I’ve argued again and again, we have immigration at our disposal. Of course, there are the usual complaints about jobs. But the weakness of this argument can be seen in a new paper Felix Salmon directs us to:

Statistical analysis of state-level data shows that immigrants expand the economy’s productive capacity by stimulating investment and promoting specialization. This produces efficiency gains and boosts income per worker. At the same time, evidence is scant that immigrants diminish the employment opportunities of U.S.-born workers.

It is well understood that the removing capital tariffs and protectionism would increase overall efficiency and incomes. Since immigration restrictions are labor market protectionism we shouldn’t be surprised to see that is has similar positive effects.

Unfortunately, journalists and pundits don’t seem to oppose labor protectionism nearly as much as they oppose capital protectionism. We would see an outcry among op-eds and pundits if we were seeing a worldwide rise in capital protectionism, because they recognize that beggar-thy-neighbor policies make everyone worse off. But no similar reaction has come from the rise in global labor protectionism. Here is how a recent report from the Migration Policy Institute describes the situation:

Confronted with the most severe economic crisis in decades and rising unemployment, governments in locations across the globe embraced a range of policies to suppress the inflow of migrants, encourage their departure, and protect labor markets for native-born workers.

From Malaysia and Thailand to Kazakhstan, Taiwan, Australia, South Korea, and Russia, many governments have sought to restrict access to their labor markets by halting, or at least decreasing, the numbers of work permits for foreigners. Others, such as the United Kingdom, tightened admission requirements. And while the policy focus of many of these countries was on reducing the entry of low-skilled workers, the United States placed restrictions on some companies seeking to bring in the highly skilled.

In addition to the results from Felix above, the wider literature on the issue tells us the quantifiable impact on wages is likely to be minimal compared to the impact on house prices. For instance, research from economist Albert Saiz found

“…a very robust impact on rents and housing prices that is an order of magnitude bigger than the estimates from the wage literature. Immigration inflows equal to 1% of a city’s population were associated with increases in average or median housing rents and prices of about 1%.”

Emphasis his. In previous research, Saiz used a classic example of exogenous immigration from the literature and found effects of a similar magnitude. Looking at the Mariel boatlift, a sudden inflow of immigrants from Cuba which increased the population of Miami by 4%, Saiz found that rents in Miami increased 8%. Overall, there appears to be a robust relationship between immigration and housing prices.

Calculated Risk tells us that “Usually housing is a key engine of recovery, especially for jobs. But this time housing is going to follow the economy.” But this is not because of economics, but politics. Instead of waiting around for the labor market to lead housing recovery, let’s use the tools we have to help housing recovery lead.

A big story today is a report out by the Economic Policy Institute that criticizes value-added scores for teacher performance evaluations. Kevin Carey at The Quick and the Ed puts this challenge to the authors of the paper regarding how much weight should be placed on these measures in teacher evaluations:

The Economic Policy Institute’s new brief, which details the many concerns with and limitations to current value-added measures, says that 50% is “unwise.” However, despite EPI’s litany of concerns with value-added, the authors, who include Diane Ravitch, Helen Ladd, and Linda Darling-Hammond, conclude that: “Used with caution, value-added modeling can add useful information to comprehensive analyses of student progress and can help support stronger inferences about the influences of teachers, schools, and programs on student growth.”

But if 50% is unwise, what is EPI’s number? The paper doesn’t specify and calls for experimentation among districts. Experimentation is good. But I’d also like to see EPI’s authors and other value-added critics put their best number on the table. I doubt they will, though, because for many, that number is very close to 0%. And defending that number would be much more difficult than pointing out the flaws in value-added.

Kevin also discusses the shortcomings of value-added in a broader perspective:

Value-added measures of teacher effectiveness are not all that great…. But, and this is an enormous caveat, everything else we currently use is worse. A teacher’s years of experience, their education credentials, their certification status, the prestige of their college or their college GPA, even in-class observations. None of these measures does as good of a job at predicting a student’s academic growth as a teacher’s value-added score. Yet, we continue to use these poor proxies for quality at the same we have such passionate fights about measures of actual performance.

Carey’s two points together highlight an important question: if the weakness of the connection between value-added scores and teacher effectiveness means we should place a low weight, say 10%, on those scores for teacher compensation, than what does that tell us about the weight that should be placed on seniority and credentials? The answer has to be much less than 10%, since the evidence suggests those are far worse measures. Test scores representing 10%, and everything else that is currently used to decide pay representing less than that would be a significant improvement over the status quo. That would just mean a pay scale that is about 80% flat.

You know what, maybe you should just be reading The Quick and the Ed instead of me.

Based on Cable News and a notable NYT column one might think that economists are perpetually at one another’s throats. This is far from the truth. The hierarchical nature of the economics profession lends an ecclesiastical air to many of our interactions. Brilliant figures are treated with enormous reverence.

To wit, when an eminent figure like Robert Barro says something that strikes most of as inane the most common reaction is shoe staring. For example, Barro writes:

To get a rough quantitative estimate of the implications for the unemployment rate, suppose that the expansion of unemployment-insurance coverage to 99 weeks had not occurred and—I assume—the share of long-term unemployment had equaled the peak value of 24.5% observed in July 1983. Then, if the number of unemployed 26 weeks or less in June 2010 had still equaled the observed value of 7.9 million, the total number of unemployed would have been 10.4 million rather than 14.6 million. If the labor force still equaled the observed value (153.7 million), the unemployment rate would have been 6.8% rather than 9.5%.

Upon hearing this no one wants to make eye contact for fear of revealing that he sees that the emperor – or esteemed economist in this case – is without his clothes.

For better or worse the blogosphere has changed that. Economists of all stripes will descend upon Barro over the next 36 hours. If he replies, which I suspect he will not, this will be an interesting moment.

From back in the day, when MB was on Blogspot

FRIDAY, FEBRUARY 29, 2008

There is No Tightrope

The analogy of Ben Bernanke walking a tightrope between a recession and inflation has become popular of late. However, I suspect that the Federal Reserve increasingly is coming to believe, as I do, that there is no tightrope. [Karl from 2010: Sadly they did not and still have not]

Inflation is here, yes. Commodity prices in general and agricultural prices are skyrocketing. This is something that we talked about here last year. However, the Japanese Scenario is becoming more salient everyday.

As I say regularly to my colleagues, "This is not just sub-prime, this is not just housing. This will get much worse before it gets better"

I am sorry that I do not have the time to post lots of interesting graphs as evidence. What I am worried about, however, is a recession within a recession and the consquences for solvency in the financial sector.

So far there have been some very high losses associated mostly with subprime mortgages. However, this is potentially the tip of the iceberg. Much larger losses will come from the set of mortgages known as Alt-A, along with consumer credit, commercial real estate loans and corporate loans.

Now, unlike subprime many of these loans will not experience high default rates in the absence of macro events such as declining home prices or rising unemployment. Therefore, those losses are starting to trickle in now. Alt-A today for example is probably at the same point in the rising default cycle as subprime in late 2006.

We see that home prices are falling but what about unemployment. If we look at the business cycle spikes in unemployment are typically led by a slowdown in residential construction and are accompanied by a drop in business investment spending. In fact by the time unemployment spikes residential construction is typically on its way back up.

This time may be different. Business investment is already slowing and unemployment rising. Yet, there is reason to believe that residential construction could fall throughout the rest of the year.

In a sense this means that we will be in the midst of a recession (high unemployment), at the same time that we are experiencing leading indications of a recession (construction slowdown). This sets up the possibility for a vicious cycle in which unemployment further depresses housing which leads to even greater unemployment, or a recession within a recession.

This scenario must be avoided. The Fed should acknowledge that inflation is a problem but should begin to brace the nation for a policy designed to beat back a Japanese style depression without regard for the immediate implications for inflation.

POSTED BY KARL SMITH AT 2:45 PM

I don’t have some all encompassing narrative of the housing bubble to weave you, or an airtight case that government policies caused the bubble, didn’t cause the bubble, etc. I just want to comment on a few points in the debate.

The argument is frequently made that Fannie and Freddie were minor securitizers by the time the bubble came to a full boil in 2006, therefore they didn’t “cause” the bubble. But the fact that private companies were able to push them out of the market doesn’t tell us anything about the initiation of the bubble. The fact is that as early as August 2002 Dean Baker, who many credit as having “called the bubble”, was saying that prices were becoming divorced from fundamentals. As you can see from Karl’s chart, this is still during a time period when GSEs constituted the vast majority of MBS issuance and were quickly ramping up:

So was Dean Baker identifying a bubble in late 2002 that wasn’t there, or were Fannie and Freddie the majority MBS issuers when the bubble started?

A lot of focus goes into who issued the subprime loans which are now defaulting and much less discussion occurs about what caused the initial divorce of house prices from fundamentals. I think Jim Hamilton’s explanation of the run-up in oil prices that led to the beginning of this recession has some applicability to what happened in the housing market. In short, prices skyrocketed because market participants (and academics) no longer knew the value of a key parameter. When demand did not subside even as oil prices went above historical levels, market participants began to wonder “what exactly is the price elasticity of oil at this level?”. As Hamilton put it:

Just as academics may debate what is the correct value for the price elasticity of crude oil demand, market participants can’t be certain, either. Many observers have wondered what could have been the nature of the news that sent the price of oil from $92/barrel in December 2007 to its all-time high of $145 in July 2008. Clearly it’s impossible to attribute much of this move to a major surprise that economic growth in 2008:H1 was faster than expected or that the oil production gains were more modest than anticipated. The big uncertainty, I would argue, was the value of ε. The big news of 2008:H1 was the surprising observation that even $100 oil was not going to be sufficient to prevent global quantity demanded from increasing above 85.5 mb/d.

Once the ratio of house prices to rents and other fundamentals became indisputably divorced from historical levels, market participants had to wonder what are the new underlying parameters were. Dean Baker said from the start that the historical levels were correct, and nothing has changed. Economists overall were agnostic. But from 2002 until 2007, those who bet optimistically were rewarded and those who bet pessimistically were punished or ignored as prices increased quickly.

If Fannie and Freddie drove the initial divorce of prices from their historical relationship with fundamentals, than they are an important causal factor. Yes, markets that myopically rewarded the most optimistic assessments of the new parameter values were a necessary condition for us to arrive at the hugely frothy markets of 2006, but so too was some first mover to push prices above historical levels.

Perhaps some of that divorce from fundamentals was real, in the sense that the equilibrium price to rent ratio grew as a result of a change in capitalization rates driven by income growth. If this is the case, then those who want to claim that the bubble was “called”, especially by Dean Baker, or that bubbles are identifiable, have a harder story to tell about when you know that a bubble has formed. What level of divorce from historical values is acceptable as real and at what level do you call it a bubble?

Adam, alerts me to Bryan Caplan full-throated embrace of the suicide fallacy. That is the notion that life must be better than never having been born because people could kill themselves but choose not to.

Bryan says

Why would a minor gift of cash be a clear-cut gain, but a massive gift of human capital be a question mark? In both cases, the recipient seems to have what economists call “free disposal” – a cheap, painless away of getting rid of the unwanted gift. Don’t want $100? Drop it on the sidewalk. Don’t want to be alive? Drop yourself on the sidewalk.

First, dropping one’s self on the sidewalk is neither cheap nor painless. I don’t want to dwell to much on the pain of either plummeting to your death or hitting the sidewalk, but there is some chance that these are non-trivial.

More importantly, however, throwing yourself out of the window has consequences not only for yourself but for everyone you leave behind. It will likely cause sadness among your loved ones. It will cause the world to view you and your family differently, likely with either pity or disdain. Neither of these are desirable for most people and both of them are likely important.

Bryan waves these concerns away but there is evidence that they do indeed weigh heavily in the minds of the suicidal. Suicide watchers say that you should be on high alert when someone starts to say things like

No one would even notice if I am gone

My family would be better off without me

I am just a burden to my family and friends

This tells us that our concern for others is likely a major block to our committing suicide.

Second, and to my mind more importantly, one of the largest downsides of being born is that you have to die. Your death will be painful for your loved ones as discussed above but it’s typically a distinctly unpleasant experience for you as well.

Most people are afraid of death in a way that they are not afraid of non-existence. Thinking about the world just after your death tends to be at minimum unnerving. Thinking about the world billions of years after your death or years before you were born tends not to be so bad.

This indicates that people are concerned about the world in which they have died, not simply about the world in which they don’t exist. Indeed, most people are not troubled that they weren’t born 20 years earlier but would be saddened to know they were going to die 20 years sooner.

Life and death are not smooth inverses of one another because the process of becoming alive creates in most animals a lifelong fear of becoming dead. This is a sunk cost for everyone who is already born but is not for people who are not yet here.

If the reason that people don’t kill themselves is because they are concerned about what will happen to the people they leave behind and because they are afraid of death then these are not arguments for the value of life. Indeed, they are arguments against the value of life.

Why?

Because as soon as someone is born there are condemned to die and almost certainly leave in their wake the pain of loss. The very things they desperately want to avoid have now been made inevitable.

Addendum: I should note that optimism bias is also a likely mitigating factor for suicide. Feelings of hopelessness are another strong warning sign for suicide.

However, evidence suggests that mentally healthy individuals consistently overestimate how hopeful they should be.

In any case we shouldn’t take the low prevalence of suicide as strong evidence for the irrationality of suicide. If suicide were the rational choice then we would expect that humanity would evolve very quickly towards being irrational.

UPDATE: I am not making an argument here that life is on the whole worth having or not. I think that’s an important question and I think a lot about it. However, I lean towards thinking that (a) Its not a slam-dunk either way, life contains an unpredictable mix of joy and misery and (b) historically some sets of lives have probably had a positive expected value and others not.

Bryan Caplan asks why economists are agnostic about whether receiving “the gift of life”, meaning being born, makes someone better off, when they are so certain that receiving a gift of $100 dollars clearly does. I think the reason we can be confident about one and agnostic about the other is that we have a good conceptions of the two separate states being compared in the $100 scenario, and don’t in the other. In the gift of money scenario one state is with $100 extra dollars, the other is a state without. It is easy both conceptually and, if we wanted, empirically, to consider well-being in these two states and determine in which the individual is better off. We have good information about what it means to be in both states.

In the other scenario, one state is controversial and we don’t have good information about what it means to be in it. What is the expected level of utility of being in the state of never being born? Immeasurable or inconceivable might be just as good of an answer. It strikes me as a philosophical question that, at the very least, economists aren’t trained to think about.

Perhaps Bryan understands that the philosophical answer here is actually clear-cut, and the problem is a lack of sophistication among economists (and myself). I’m not convinced this is the case, but I am willing to consider it. My main objection is that it holds radical moral implications that seem to violate common sense morality. For instance, if you take seriously the notion that the utility of not being born is less than the utility of being born, it seems to me that the moral imperative is for everyone who is capable to be reproducing at the maximum rate possible, because the marginal utility is likely massive. Surely the positive marginal utility of a life of poverty with 20 siblings relative to the utility of not being born is greater than the negative marginal utility of the 20 siblings and parents being burdened with one more family member. So when do you stop? Are Jim Bob and Michelle Duggar the most moral people on the planet?

If you argue that individuals should act selfishly, which somehow I think Bryan would, then there is a huge market failure whereby the unborn are unable to contract with their potential parents to pay for life. This argues for taxation of everyone (the set of people who are born) in order to subsidize reproduction. Yes, we indirectly do some of this already, but this should trump all other charitable and redistributive concerns.

So maybe Bryan is right and the utility of not being born is lower than the utility of being born, but if he is I think we are living in an incredibly immoral world with the largest market failure that has ever existed.

Every three months someone on the internet rediscovers the old color photographs back from before it seems like there were color photographs. This is one of my favorites of those. So apropos of nothing, I give you this:

There is no reason to fear deflation in the price of movie tickets. According to the National Association of Theater Owners, prices have increased $0.40 in 2010, which is an over 5% increase.

This is not entirely price inflation, as part of it reflects a growing number of 3D movies, which charge higher prices. So prices are going up, but you get to see Shrek in 3D, so it all evens out right?

Apparently the industry is beginning to believe they are pushing prices up to the point where consumers are becoming more price sensitive. The article linked above has this account:

Notable was an AMC statement in late May, which called the $20 list price for an IMAX-3D “Shrek Forever After” presentation in Manhattan “incorrect.” Just two months earlier, the chain had raised its premium 3D admissions cost from $16.50 to $19.50.

I know, I know, you’d gladly pay $50 for Shrek in 3D, but not apparently not all consumers feel the same way.

The Conservator’s Report on Fannie and Freddie is out.

Fannie Mae and Freddie Mac are members of a long list of individuals and entities including Gary Condit, Tom Delay, Michael Jackson, Rod Blagojevich and JonBenet Ramsey’s parents. These are folks who were unjustly tried and convicted in the popular press essentially on the grounds that they were creepy or otherwise unsavory characters.

As I hope to continue to argue, being creepy, a bad person, or even a usual suspect does not make one automatically guilty of any particular crime. In this case government subsidies in the housing market are a bad idea for a host of reasons and have been for years. I will testify to this with vigor and passion.

However, that does not mean that Fannie or Freddie caused the housing bubble. Indeed, by my count they were among the biggest victims of it.

The proper question is not: What story is consistent with my general philosophy or worldview?

The proper questions is: What story is consistent with the facts?

Fact One: Fannie and Freddie’s primary business of subsidizing conventional loans was not a driver of the housing the bubble. Indeed, conventional loans represented less than a third of all mortgage originations during the peak price acceleration years.

This was a phenomenon of private-label non-conventional loan securitization.

1.1 Peaking in 2006 at a third of all mortgages originated, the volume of Alt-A and subprime mortgages was extraordinarily high

between 2004 and 2007. In 2005 and 2006, conventional, conforming mortgages accounted for approximately one-third of all

mortgages originated[ . . .]

1.2 Private-label issuers played a large role in securitizing higher-risk mortgages from early 2004 to mid-2007 while the Enterprises

continued to guarantee primarily traditional mortgages.

Fact Two: Fannie and Freddie lost market volume during the boom. That is, during the boom not only did the fraction of loans securitized by Fannie and Freddie fall, but the absolute number fell. At the same time the absolute number of private-label securitizations rose.

There is a simple and obvious reason for this. The development of structured products meant that for many consumers the free market offered a more attractive loan than the government subsidized one.

Fact Three: The major losses to Fannie and Freddie came through their expansion into guaranteeing non-traditional loans, not through their portfolio. That is, yes like every other financial entity Fannie and Freddie were buying subprime packages in the secondary market. However, these losses were relatively mild.

The Investments and Capital Markets segment accounts for $21 billion, or 9 percent, of capital reduction from the end of 2007 through the second quarter of 2010. Losses in the Investments and Capital Markets segment stemmed from impairments of private-label securities, fair-value losses on securities, and fair-value losses on derivatives (used for hedging interest rate risk).

Fact Four: The key change in the Fannie / Freddie business model was their expansion in the types of loans they willing to guarantee. In particular moving into the Alt-A and Interest-Only categories.

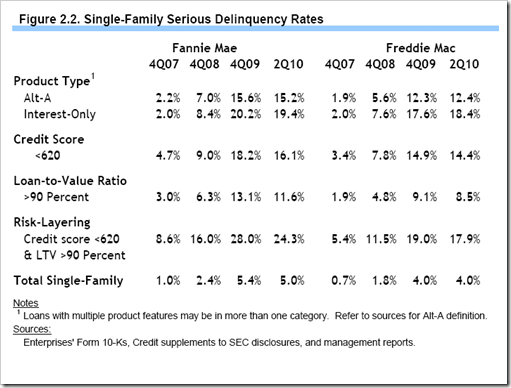

As we can see these loans began to seriously underperform as the economy deteriorated. These loans were not a part of the original “crap hidden by structure” subprime business. Fannie / Freddie borrowers on had on average credit scores above 710 and equity (or down payment) of above 25%.

Also notice how loans with low credit scores and high loan-to-value had the largest delinquency rates in the beginning but then were eclipsed by Alt-A and Interest-Only loan categories as the economy deteriorated.

Fact Five: The higher number of Alt-A and Interest Only loans combined with ultimately higher delinquency rates have meant that a plurality of losses have come from these two categories. These loans were vulnerable not because the borrowers were poor low-credit individuals that the government was taking pity upon but because the loan concepts were predicated on rising or at least stable housing prices.

Fact Six: Areas with the largest collapse in home prices have accounted for most of Fannie and Freddie losses. Refer to the same graph above.

This is further evidence that it was the collapse of the bubble and not betting on people who were poor credit risks that induced major losses at Fannie and Freddie.

My Conclusion

The wave of housing price increases was kicked off by changes in private label securitization. These changes left Fannie and Freddie with a smaller market share and lower absolute level of securitizations. Fannie and Freddie attempted to adjust their basic business practices to stay competitive in bubble markets and among aggressive borrowers.

These adjustment left Fannie and Freddie exposed to a large decline in housing prices. This is exactly what happened and Fannie and Freddie reaped enormous losses because of their exposure.

Had Fannie and Freddie stuck to their traditional role of guaranteeing low value traditional loans rather than trying to stay competitive in bubble areas their losses would have been substantially less.

In short, attempting to subsidize the American dream for low and moderate income families may be a fundamentally bad policy. However, it does not appear to be either the origin of the housing bubble or the source of Fannie and Freddie’s trouble.

In discussing ways to stimulate the housing market, Felix Salmon wonders why we aren’t seeing more landlords buy up cheap homes to rent:

The backstory here is basically the big secular shift that Richard Florida talks about a lot, especially in his latest book. In order to have more renters we’ll need more landlords, and they don’t seem to be buying, record-low mortgage rates notwithstanding. What’s going to entice them into the market?

One way to encourage more landlords in some areas would be to remove rent controls. Allowing landlords to raise prices increases the value of the investment to them, and thus increases their willingness to pay. In most places in the country this has gone by the wayside, but according to the most recent American Housing Survey there are still 529,000 housing units subject to rent control. That’s nothing to sneeze at.

Are there any other regulatory burdens preventing people from becoming landlords? The legal documents required are pretty lengthy, but I can’t picture that being a serious impediment. Any suggestions?

It has apparently become a complaint that the Obama administration has not been arresting and deporting enough illegal immigrants. According to Suzy Khimm, subbing in for Ezra Klein, while workplace raids have gone up 50% since the Bush administration, arrests and deportations have gone down 80%. This apparently has at least one former Bush official saying that Obama’s policy is “de facto amnesty” and they are “turning a blind eye to entire categories of aliens”. But no matter what Obama is doing, you would expect arrests and deportations to be going down right now, since immigrants are already deporting themselves, so to speak.

Contrary to the popular perception that illegal immigrants come here to lay in the shade and grow fat off of our generous welfare state that is freely available to illegal immigrants, they actually come here to work. Labor markets are thus a key determinant of immigration, and when labor markets get tight illegal immigrants leave. This inexplicably colored chart from the Office of Immigrant Statistics tells the story:

Between 2000 and 2008 the illegal immigrant population grew by 3.1 million, from 8.5 to 11.6. From 2008 to 2009, the latest year for which I could find numbers, the population decreased by 800,000, from 11.6 million to 10.8 million. These numbers are as-of January 2009, and I’m betting that downward trend has continued over the last 19 months since this measurement was done.

While the decrease may not be huge percentage-wise, especially compared to the 80% decrease in arrests and deportations, it is an indicator that the illegal population is currently experiencing a large amount of unemployment or underemployment. This decrease in illegal immigrant employment would also partly explain why arrests and deportations are going down: since the raids target workplaces, it’s harder to find them if more of them aren’t working.

It’s a lot easier to arrest and deport illegal immigrants when they are flowing into the country by the hundreds of thousands than when the population is decreasing by the hundreds of thousands. So maybe critics can lay off Obama on this and stop demanding that he actively destroy jobs in the middle of a recession.

Over at Econlog, Bill Dickens is trying to convince Bryan Caplan that signaling does not explain the majority of the value of higher education. Two of his reasons why education is productive is that is has a value as a consumption good, and as consumption capital:

2. Education is a consumption good. This should be self explanatory. At the margin school may be work, but infra-marginally at least some (if not most) people actually enjoy the reading, the lectures, the homework, etc.

3. Education is not just investment in work capital, its also an investment in consumption capital and social capital. I feel much more at home in the world due to the fact I understand certain cultural references… The shared culture produced by the education experience expands our common language with a lot of meaning, and that produces huge network externalities. Knowing history does help me do my job, but it is much more important that it allows me to make analogies that will be understood by acquaintances.

As an explanation for why people value college, this has some appeal. As an explanation for why college has a social value, I think it’s a pretty weak defense. Grant for a moment that it is entirely factually correct, is there any reason why this should be subsidized?

For the first thing this is a terribly regressive subsidy, primarily benefitting people with above average ability and wealth. Second, if the goal is to increase “social capital” for consumption purposes this is probably the least efficient way to do it. The money would be better spent subsidizing high-minded TV shows that make audiences more literate and cultures, or providing grants for creating and broadcasting informative documentaries or books that are catered towards people who normally wouldn’t watch them or read them. You would almost certainly generate more consumption capital and welfare by providing free subscriptions to the New Yorker ($40) for 175 households than a year in college ($7,020) for one person, and it would cost the exact same.

I’m not defending the signaling theory, Bill Dickens’ theory, or any other theory of education as a matter of fact. But proponents of more education investment should not look to Dickens’ criticisms of the signaling theory education, because even if he is right education is still way oversubsidized.

My once and future dream is that the blogosphere would replace academic journals as the primary medium of intellectual exchange. We are far, far, far from that but this debate over deflation is getting sufficiently wonky that a boy can dream. If only there was some easy way to incorporate an equation editor into a blog writer, we would be off to the races.

Now to the subject at hand. Stephen Williamson rides in to defend Kocherlakota:

What [Krugman, Rowe, Thoma and Harless] are objecting to in Kocherlakota’s speech is one of the most innocuous things he said. Here’s the simplest example I know. Suppose a cash-in-advance model with a representative consumer, period utility u(c), discount factor b, constant aggregate endowment y. c is consumption. The consumer needs cash to buy c each period. Suppose y is a fixed quantity of output received by a firm, which is sold for cash within the period, and then the cash is paid as a dividend to the consumer at the end of the period. Have the money stock grow at a constant rate m. The real interest rate is constant at 1/b -1. The nominal interest rate is (1+m)/b – 1, and the inflation rate is m. Constant m implies a constant nominal interest rate and a constant inflation rate. If m < 0, there is deflation, and the nominal interest rate is sufficiently low to support the deflation. I can think of the instrument the central bank sets as either the money growth rate or the nominal interest rate – that part is irrelevant. This type of result holds in virtually all monetary models, though of course sometimes the real rate may depend on the inflation rate. That’s not a big deal though. What’s the problem?

Let me say again. There is absolutely nothing inaccurate about what Williamson is saying. It falls simply and elegantly out of our monetary models.

The blogosphere is reacting with shock and despair because the conclusion doesn’t look anything like what they would expect to happen in the real world. In the real world if the Fed set a permanent low interest rate target all of our intuition, training and observations say that the result will be hyperinflation not deflation.

The question is: How can we reconcile the two?

As is often the case the key difference is hidden in a seemingly innocuous turn-of-phrase. Williamson writes

I can think of the instrument the central bank sets as either the money growth rate or the nominal interest rate – that part is irrelevant.

In some sense what Williamson is saying here is a mathematical necessity. For every nominal interest rate there exists some path of money which is consistent with it. I can choose one, or I can choose the other.

Where the confusion sets in is that a semi-plausible sounding nominal interest rate target can mathematically imply an obviously insane path for money. Yes, there is a one-to-one correspondence between the two in fact. Where the correspondence breaks down is in intuition.

For our particular example, we are considering a permanent nominal interest rate of .25% On the surface that seems like an, odd, perhaps dangerous, but doable goal. In reality its bat shit crazy and no one would ever believe that the Fed even had the ability to do it. Allow me to explain.

If the Fed is truly committed to a .25% nominal interest come-what-may then it is committed to expanding the money supply as rapidly as money demand requires. It doesn’t matter how many trillions upon trillions of reserves are required to meet that target, the Fed has committed to meeting it.

The key element you have to rap your mind around is that the Fed is doing this irrespective of the consequences. You have, for the purposes of this thought experiment, fixed the nominal interest rate for all time.

Now then what happens out in the real world.

Well, a permanent short term nominal rate of .25% means that long term rates must also be .25%. Is there some bend to the yield curve? Aren’t investors worried about inflation, deflation, etc? No, they are worried about nothing because the Fed is absolutely going to keep short term nominal rates at .25%. This is fixed and forever true.

If long term rates were any different then I could simply arbitrage the two and make a guaranteed profit. So all long rates are now .25%.

This means that Fannie / Freddie mortgage rates collapse to around .25%. Remember there is no prepayment risk in this world because interest rates will always and forevermore be .25%. In addition, there is virtually no risk to 30 year interest-only balloon mortgages, because rates will always be .25%. So that means I could borrow 300K for my home and my monthly payment to the bank would be $62.50. So we have essentially free mortgages.

Car loans collapse to .25% plus risk premium. Credit Card offers come through the mail that say 0% APR on all purchases, all balance transfers, all cash advances (plus 3% processing fee) FOREVER. Credit Cards can do this because the cost of funds is only .25% and they make 3% off the merchant fees. Add in the profits from late fees and there is no need to charge the on-time customer a dime, ever.

Similarly, corporate bond rates collapse. Mergers and Acquisitions fly into high gear as massive leveraged by-outs sweep Wall Street. There is nearly free money FOREVER. If you think you can get a return on equity of at least .25% in all periods then buying the company is a slam dunk.

All of this activity sends stock prices sky high, it sends home prices sky high, it sends commercial real estate sky high. The massive increase in paper wealth accompanied by free credit card purchases sends consumers on the shopping binge of a lifetime. The real economy goes white hot, and items are flying off of store shelves. Prices on everything rise: food, soap, paper towels, you name it, they can’t keep it in the store. There is free money – forever – and we are all rich.

In short, the result is massive inflation. This inflation would tend to push up nominal interest rates via the Fisher Effect. However, it can’t because the Fed is committed to .25% come-what-may.

That means that the Fed accelerates the expansion of the money supply so that even given huge inflation expectations the nominal interest rate stays low. This in turn feeds more inflation expectations which feeds more money creation and so on and so on.

Literally the continuous time models tell us that the inflation rate reaches infinity. That is,we shoot to a new, higher price level in zero time. That price level is one that is consistent with stock and home prices being discounted at .25% forever. The price level would have to be such that people as wealthy as they would be from those asset prices and with as easy access to credit as would come from 0% APR FOREVER, still would not want to purchase more output than the economy was capable of producing.

Needless to say these are extremely high prices since people can borrow so cheaply knowing that on paper they are so wealthy.

Like I said, inside the model this happens in zero time. That’s of course because inside the model everyone knows, that everyone knows, that everyone knows . . . that this is the end equilibrium and everyone faces zero costs to jumping straight to it.

So stores go ahead and figure out what the equilibrium price is and they just charge that. Same with homeowners, stock holders, etc. We see an instantaneous jump to a new equilibrium.

In the real world that is not possible. So, if the Fed tried such a policy it would get hyperinflation. It would get inflation that fed on itself in this same way but never actually reached an infinite rate. Eventually, however, we would hit the constraining price level.

What about the deflation?

Well with the nominal rate lower than the real rate, you want to engage in all possible investment today. By assumption in this model there are no adjustment costs so absent price constraints this would be possible. However, there is not an unlimited amount of investment goods and services to go around.

You want to build a thousand factories but there are not enough construction workers to do it. So construction prices go higher and higher to stop people from wanting to do it all today. However, this opens up an arbitrage opportunity.

As the owner of a construction firm, I can go to you and say, John, I know you want this factory built ASAP, but I’m a just completely booked. How about I do it for you next year for a little bit less? Are you willing to go for this?

Well if you don’t have the factory today you loose out on 1% of real return at a cost of only .25% in funds. So, if the factory is at least .75% cheaper next year its just as good of a deal for you to wait. So my firm offers you a cheaper deal next year and you agree to wait.

Next year, the same thing happens to another guy. He wants a factory now, but my firm is all booked up. Will he accept a .75% reduction in cost to wait? Yes, he will.

And the year-after-that, and the year-after-that, and the year-after-that.

So we have set ourselves up for permanent deflation in investment goods. It turns out the same thing has to be true in consumption as well. That’s because way back in the back of this model is a condition that essentially causes the average social discount rate to be equal to the real rate of interest.

That is, our society wide willingness to forgo consumption has to on average be the same as the return on investment. This means that as a society we are also willing to wait on the new TV or the new Ipad if we know its going to be cheaper later. In practice that would mean some people can’t wait and some people will be more than willing to wait. But, getting the average willingness to wait to match up with the realities of production will require .75% price drops each year. Again, permanent deflation.

So that’s how the model works its way into real life. A commitment to a permanent .25% nominal interest rate would produce permanent deflation but only after a raging period of hyperinflation.

Such a period would be so insane that no one would believe the Fed had the stones to see it through. That’s part of why the argument: a permanently low rate leads to deflation seems so insane to most economists. The process of getting to deflation would be violent and likely untenable.

A recent Edmunds report shows that used car prices are up on average 10.3%, and for some models over 30%, over the last year. This has been attributed by Radley Balko, Edmunds, and others partly to the governments cash-for-clunkers program. I was and am not a fan of cash-for-clunkers, but I don’t think we know how much of this is due to clunkers and how much is due to falling incomes. In fairness, neither Balko nor Edmunds try to lay the blame entirely on clunkers, and Edmunds even discusses the difficulty of isolating the effects, but it is worth explaining the economics of why else prices may have gone up.

It might seem like common sense that that when people’s incomes go down they decrease their demand for stuff, so prices of stuff should also go down. Thus, we would expect in a recession prices for used cars to fall. But that is not always the case. There are three types of goods: inferior goods, normal goods, and luxury goods. When income goes up by, say, 10%, demand for inferior goods falls, normal goods goes up but by less than 10%, and luxury goods goes up by more than 10%. It is quite believable that used cars are an inferior good, so that the decrease in incomes has led to an increase in the demand for used cars, which could explain some unknown portion of the price increase we have seen. Without some empirical evidence it is premature to point at the 10% to 30% increases and blame it on cash-for-clunkers. This would make for a good paper topic for some enterprising student….. Or if someone wants to know bad enough to pay for it, I’d be glad to crunch the numbers.

Will Wilkinson defends himself and his brand of libertarianism from Dan Foster, and all I can say is read the whole thing. Here is one quote to pique your interest:

Foster’s worry about my sort of libertarianism isn’t really that it’s a “rationalist” ivory tower abstraction remote from the lived experience of the allegedly natively libertarianish American tradition. It’s that the application of any rational scrutiny (libertarian or not) to the efforts of conservative elites to construct bullshit American-heritage narratives tends to get in the way of elite conservative political aspirations.

It reads like Will’s being walking around for years waiting for someone to make just this attack on him; the kind of thing he wrote in 10 minutes because he’s written in his head 100 times already.

Andy Harless corrects Kocherlakota’s thinking on deflation. Andy has the story right though I’d like to walk through the results of the “pure model” perspective that Kocherlakota seems to be speaking from. There is nothing wrong with the basic reasoning, as I see it, its just how Kocherlakota employs it.

Andy Harless corrects Kocherlakota’s thinking on deflation. Andy has the story right though I’d like to walk through the results of the “pure model” perspective that Kocherlakota seems to be speaking from. There is nothing wrong with the basic reasoning, as I see it, its just how Kocherlakota employs it.

Kocherlakota suggests that the superneutrality of money implies that a low Fed Funds rate will lead to permanent deflation. This is true in a frictionless world with perfect information.

A permanently low funds rate combined with a constant real rate of return would imply deflation. It is also the case that the Fed choosing a permanently low funds rate would cause the deflation to come about. The question is: how do we get to deflation from here.

You actually wind up with what’s known as a bang-bang solution. That’s where the economy instantly jumps to a new equilibrium path. That is, everything we think we know suddenly changes and then works itself out from there. There is evidence of quasi-bang-bangs in real life. When the stock market suddenly crashes on a piece of bad news but the slowly creeps up from there, that’s essentially bang-bang.

With money and deflation what you’d have to be suggesting is that as soon as people realized that the Fed was committed to this path, prices on everything, not just stocks and bonds but everything, instantly jumped sky high. So, high in fact that from there on out we would be set up for permanent deflation.

In the real world such an instant transition is not possible because there are frictions and uncertainty. What is possible is hyperinflation. Hyperinflation that would then leave the price level so high that deflation from then on out was the norm.

UPDATE: The stock market analogy seems to interest people so let me give you a specific example of a bang-bang that works how Kocherlakota is thinking.

Suppose, that you found out that the future of Ford Motor Company was way more uncertain than you thought. They are facing risks that no one saw until Erin Burnett pointed them out at 2pm on Wed. What happens?

Well one thing we know is that investors need to be compensated for risk. So that means the average return from holding Ford stock should rise. Ford is paying no dividend, however, so that return must come in the form of greater capital gains.

Huh? You are telling me that finding out that the fact Ford is facing a bunch of risks will raise the expected capital gain?

It sure will.

Or at least it will from 2:10 pm onward. From 2pm (the moment we find out) until 2:10pm what we will see is a disastrous crash in Ford stock price. So disastrous that from there on out the expected gains will be higher than they were before.

That’s bang-bang and it can work out so smoothly because there is an actual formal market in Ford stock which clears out most of the frictions. In the world of normal goods and prices such smooth transitions are not possible.

The thought experiment in more detail.

The blogosphere is tickled pink over Arnold Kling’s quip

Old consensus: we need Freddie and Fannie in order to make housing "affordable."

New consensus: we need them in order to "prevent further house price delclines," in other words, to make housing less affordable.

Arnold’s a clever guy, no doubt. Yet, there is really no disconnect here. The essence of a subsidy is that it drives prices to buyers down and prices to seller’s up. If someone favored a subsidy it should be precisely because they both want higher prices and more affordability.

Paul Krugman is too kind to his intellectual opponents. Yes, I wrote that.

Here’s what Kocherlakota said in a speech after the meeting:

Whatever the source, though, it is hard to see how the Fed can do much to cure this problem. Monetary stimulus has provided conditions so that manufacturing plants want to hire new workers. But the Fed does not have a means to transform construction workers into manufacturing workers.

And this is strikingly true this time around. Kocherlakota would have us believe that there’s a big problem of mismatch because manufacturing is trying to hire, while construction has slumped. But here’s the employment reality:

This is taking it too easy. The Fed most certainly has the means to transform construction workers into manufacturing workers. Its called inflation expectations, which in turn influence the real interest rate.

There is no activity which is possible and yet still unprofitable at some real interest rate. I don’t mean this in a tautological “sufficiently low real interest rate” sense. A profitable real interest rate can be calculated. Lets crunch the numbers.

We start by asking, what is the return on investment in this activity? There is no reason this needs to be a positive number. Negative returns work just fine. Or in other words, exactly how much money does Korchelokta think manufacturing firms are going to lose by hiring former construction workers: 10%, 90%, 99.9%. Any of those numbers will do.

Lets suppose these construction workers are real idiots. They don’t know up from down. Lord only knows how they swung a hammer but apparently it was divine intervention. At manufacturing they are all but useless. So we’ll assume that by hiring these workers we will lose 99.9%.

How does that work?

We hire workers this year. We pay them $50K. However, what they produce after a year of work is only worth $50. Real knuckleheads here. Can the Fed possibly make hiring these guys worth your while? It certainly can.

You paid them $50K. Your alternative would have been to put this $50K in a trusty savings account or to buy government bonds but the yield on those are 0% nominally.

If you hire these workers you get $50 worth of real goods next year. Suppose you expected, however, 200,000% inflation. That means next year things will cost 2000 times what they cost this year. Then that $50 in real goods would sell for $100K in nominal terms.

So, you have $50K this year and if you hire these workers you will have $100K next year. Alternatively, if you save or horde your money you will have $50K next year. It is clearly twice as good to hire the knuckleheads.

Now, of course having 200,000% inflation will send people flying into real goods and an alternative medium of exchange. Though it is worth noting that as long as taxes and debt are due in US Dollars, alternative mediums have their limits.

The point, however, is that it is within the Fed’s power to make holding cash economically painful. It is within their power to make investments which would lose money in real terms, make money in nominal terms. As long as the currency is still in use, its nominal returns that we care about because you buy stuff with money, not bartered real exchange.

That’s the thing that is lost in the economic intuition of many. They are so used to canceling out inflation that they forget that we actually live in a nominal world.

You become rich by having lots of money, not by producing lots of real return. Similarly, you will be hauled into bankruptcy if you can’t meet your nominal obligations, regardless of the real value of goods and services set to change ownership.

Now, when we are away from the Zero Lower Bound, that distinction doesn’t really matter. Smoothly functioning financial markets will always incorporate inflation into the price of money. As long as nothing unexpected happens nominal concerns can be swept away in favor of the underlying real dynamics.

However, this is explicitly not the world we currently inhabit. At the Zero Lower Bound nominal becomes what matters. The real interest rate becomes a function of expected inflation and we cannot think about real profits independent of nominal ones.

Now could that possibly be a good idea? Isn’t the Fed creating massive allocative inefficiency as well as enormous pain by debasing the currency?

Well, yes 200,000% inflation would likely be ruinous. However, a world in which 200,000% inflation was required to escape the Zero Lower Bound would already be ruined.

It would be a world in which the best available use of a 50K a year worker would be producing $50 worth of value. If that is the case then ruination is already upon us.

In reality we are dealing with mildly negative real returns. Perhaps, a $50K worker can only $47.5K in goods and services. A five percent loss over the year. This requires much less inflation, 6% would do.

Even still you might think that this is inefficient. Why would we want to encourage activities which lose value? However, the relevant question is not whether an activity makes or loses value, it is whether it is the most profitable use of your resources. That is, the relevant cost is always opportunity cost. What else could you have done?

If the alternative world is one in which the 50K a year worker produces nothing of value to himself or anyone else then that’s a 100% loss. We have to always remember than unemployment – that is people who want to work at the prevailing wage but cannot find a job – is allocatively inefficient. If the worker drops out of the labor market that is another issue. However, the natural rate not withstanding, if workers are looking for work at the prevailing wage and cannot find it, then we are in an inefficient world.

I think people get sucked into a liquidationist point of view because they see the economy as analogous to a really big household. That is, they see unemployment as the necessary pain after a bout of spending because they think about a household that has overspent its credit card.

However, unemployment is not restrained consumption. That is, unemployment is not people doing with less, curtailing their desires or living within their means. It is people working and producing less. Unemployment is failure of the labor market to clear. This is not repayment for sins, it is inefficiency.

True repayment would be a contraction in consumption which lead to an immediate boom in investment. True repayment would not have workers stop working but would have workers stop making TVs and flashy cars and instead build steel mills and tractors. It would mean that we have fewer of the shinny things that make us happy today and more of the basic industrial goods that will make us richer tomorrow.

However, that is not what happens when unemployment rises. We get less of everything. Frighteningly, investment falls particularly dramatically in a recession. This is just making a bad situation worse.

Luckily there is something we can do it about. The 4% Club is still accepting nominations

A nail salon has made national headlines recently by charging an overweight customer an extra $5 because they were over the official weight limit of the pedicure chair, which can cost $2,400 to fix. This has been called price discrimination, and has been compared to the practice of dry cleaners to charge more to clean women’s clothes than men’s clothes even though the cost to the cleaner is the same. But in order for something to be price discrimination, the price differential has to be greater than is justified by different costs. In fact, if it costs more to serve an overweight person than a not overweight person, then charging them the same is price discrimination.

The FindLaw blog Free Enterprise does not appear convinced by the different underlying costs justification in this case, because:

…it is difficult to see how a $5 surcharge, unless charged hundreds of times each day, would help defer the over $2,000 dollar cost of fixing a broken chair. In the long run, the negative publicity the salon is receiving may end up costing much more.

But the negative publicity costs are probably why the charges aren’t higher for overweight customers. This constraint on the store’s price setting means underlying cost differences may be much larger than $5. The marginally higher prices for overweight customers will recover more of the underlying costs and are therefore less price discriminatory than when everyone is charged the same.

So is this type of differential pricing a “good” thing? I won’t weigh in on the morality of the issue, but at a first pass it does seem more efficient. However, if other customers value going to a salon that charges everyone the same regardless of weight, than they may find another salon to go to. This is the long-term PR cost to the firm. In this case, as in many other real life cases, otherwise efficient differential pricing based on personal characteristics may not be efficient when you consider that customers have preferences over these pricing issues aside from any direct monetary benefits or costs to them. This is why market outcomes can be “fair” without regulation despite the fact that narrowly defined self-interest may predict “unfair” outcomes. People value what they see as fair business practices, and they are willing to pay for it.

There has been a lot of chatter around the blogosphere about Narayana Kocherlakota’s speech in Michigan last week, and seeing as I am trying to catch up on news, I think that is a good a place as any to start. First, here is the whole speech, so that you can read it if you would like.

The big focus, especially among left-leaning commentators, has of course been Kocherlakota’s comments on the unemployment situation. The only troubling thing to me about a monetary policymaking body discussing unemployment is the fact that it is happening at all. I don’t believe that there is anything “special” that monetary policy can do to alleviate unemployment — even in a booming economy. The capacity of monetary policy to act is to keep nominal GDP growing at a constant rate, year over year, and to tighten a little when it overshoots and loosen a little when it undershoots — such that the trend path of NGDP is a constant upward slope. I’m not an expert on the welfare-maximizing trend rate of NGDP…but people who are much smarter than me on average advocate 5% NGDP growth.

In any case, in the speech, Kocherlakota breaks down how Fed meetings operate, and then breaks down his “forecast speech” that he gave to the FOMC. Along those lines, he has three points: GDP (real), inflation, and unemployment. On those three points, he has this to say:

Typically, real GDP per person grows between 1.5 and 2 percent per year. If the economy had actually grown at that rate over the past two and a half years, we would have between 7 and 8.2 percent more output per person than we do right now. My forecast is such that we will not make up that 7-8.2 percent lost output anytime soon.

[…]

The Fed’s price stability mandate is generally interpreted as maintaining an inflation rate of 2 percent, and 1 percent inflation is often considered to be too low relative to this stricture. I expect it to remain at about this level during the rest of this year. However, our Minneapolis forecasting model predicts that it will rise back into the more desirable 1.5-2 percent range in 2011.[1]

[…]

Monetary stimulus has provided conditions so that manufacturing plants want to hire new workers. But the Fed does not have a means to transform construction workers into manufacturing workers. […] Given the structural problems in the labor market, I do not expect unemployment to decline rapidly. My own prediction is that unemployment will remain above 8 percent into 2012.

[1]5yr TIPS spread is at 1.43, 10yr @ 1.55.

Now, not making up the lost employment is partially a function of his previous point about per capita GDP remaining under trend for an extended period of time. This is the cyclical component of unemployment. Cyclical unemployment is created due to the relationship of the economy to the cycle of time. As such, the level of cyclical unemployment correlates well with the business cycle, seasonal factors, etc. I believe that most of the unemployment we are currently experiencing is of cyclical nature.

I think the error in Kocherlakota’s thinking stems from this quote:

Monetary stimulus has provided conditions so that manufacturing plants want to hire new workers. But the Fed does not have a means to transform construction workers into manufacturing workers.

This is wildly baffling. Not only does Kocherlakota make the forecast above — i.e. we will not be hitting any of our targets (nominal or otherwise) any time soon — he also states that he believes that money has been easy. That implies that monetary policy has zero effect on the economy, any time. He also identifies that low rates for an extended period of time are a sign of monetary failure, but does so in a future-orientation. While it is true that low rates can (and do) accompany* a deflationary “trap”, the policy prescription that follows is not to raise short-term rates regardless of the composition of employment. The proper policy response in that situation is to set a positive nominal target, level targeting and commit to move heaven and earth to hit that target.

That, rather than his statements about unemployment, is what I view as Kocherlakota’s underlying problem.

*H/T to Andy Harless in the comments. Also, read his post about Kocherlakota’s statements.

Low interest rates are generally a sign that money has been tight, as in Japan; high interest rates, that money has been easy.

We let this happen in the United States in the 1930s. We let it happen in Japan in the 1990s. Two lost generations is enough.

I quote the Chairman of the Federal Reserve Board of Governors

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.

Conor Friedersdorf beats the drum on understanding liberals.

Awhile back, when I reviewed Liberty and Tyranny by Mark Levin, I argued that its fatal flaw was its author’s insistence on the straw man that today’s liberals are fundamentally driven by Statism, whereas actually what motivates most of them is a substantially different project . . . If you’re trying to actually understand someone like Matt Yglesias, whether to effectively argue against his views or to engage him persuasively, the frames of "statism" and "liberty versus tyranny" are almost completely useless.

I am reminded how much of the modern right has become almost a caricature of 70s era liberal stereotypes of it. Part of the problem, as I see it, is cradle-to-grave conservatism – an entire culture that regards liberal views as by their nature the product of fools, charlatans and would-be tyrants. Indoctrination leaves one ignorant of the core arguments of his own ideology.

Virtually no one is born a libertarian in the Hayek-Freidman sense. It is an intellectual journey that almost always begins from the basic liberal position and maintains its sensibilities throughout. If you try to skip that stage you are doing yourself a disservice. If you don’t understand liberalism, I am not sure how you understand libertarianism.

In Free to Choose Milton Friedman, for example, repeatedly speaks with the mind of a free marketer and the soul of liberal.

Mr. Ramsey [British Unemployed Worker]: The jobs are out there you only come up with about 45 pounds a week. And you need a doctors stamp over there. You see, you finish up with about 29 pound. So what good is it working? You still get the same thing, you know what I mean? I can’t make any sense of it.

Friedman: Of course, he’s quite right. It may not pay to get a job now. That’s not his fault and I don’t blame him. He’s acting sensibly and intelligently for his own interest and the interest of his family. It’s the fault of the system which takes away the incentive from him to get a job.