You are currently browsing the tag archive for the ‘Krugman’ tag.

When smart people say something that seems wrong it’s a good idea to think you’re missing something. Yet, the possibility of correcting Krugman and achieving international (or at least intra-household) fame is too much to resist.

Krugman says

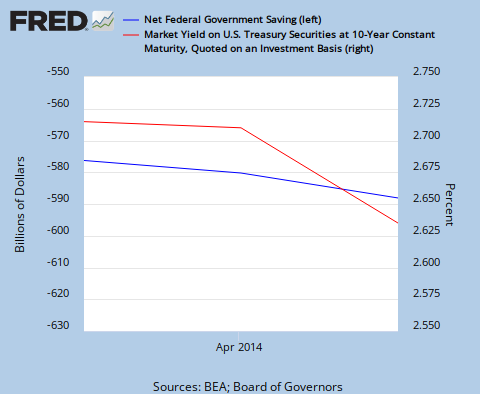

Some comments on various blog posts ask what evidence we have that liquidity trap economics is any different from normal economics. Um, the answer is staring us in the face: the failure of interest rates to rise despite very large budget deficits:

The problem here is that large budget deficits should drive expansion and expansion should drive up long rates.

Suppose that the economy was in a depression because there is a savings glut. Then the government announces that it will sop up the savings glut and end the depression. This should raise expectations of future growth which in turn should raise long term interest rates.

We could think about this through the monetary channel and say, large budget deficits should decrease the amount of time the Central Bank is up against the zero lower bound and thus raise the path of short interest rates. Through arbitrage long interest rates should give the same yield as the path of short rates.

So wouldn’t the failure of long rates to rise in the face of an expanding deficit be evidence that deficit spending is not going to work?

Paul Krugman is doubting that financial collapse was a key part of the recession

My take on the US economic crisis has increasingly been that banks were less central than many people think, while the housing bubble and household debt are the key players — which is why financial stabilization by itself wasn’t enough to produce a V-shaped recovery.

I am not sure how central people think the banks were so I am not sure how hard to push back.

My take is that household debt and the banking collapse were symbiotic in their destructive nature. At the center of the story, however, is money and credit.

Highly leveraged households meant that consumers were very sensitive to economic disruption. The danger in having a lot of leverage is that when things go bad they go really bad. The flipside of course is that when things go good they go really good. We have to have some story about how things started to go bad before household debt can be invoked to explain why things went really bad.

Debt is ultimately just a promise. Lots of debt is precarious when there are many interlocking promises that depend crucially on one another. If one person flakes – as eventually one person will – the whole network could crashing down.

When the banking sector collapsed it created a huge flake. Lending fell dramatically. Projects and production that were dependent on a smooth supply of lending could not go through. This rocked many households who were themselves in locked into sensitive promissory positions.

Now knowing that a flake was possible we might step back and ask either “why did we allow such sensitive networks to develop” or “why were housing prices allowed to climb on top of these tightly wound promises”

However, the more fundamental mistake was thinking that the Fed was prepared to firewall this whole thing if it went bad. It wasn’t that people couldn’t see the debt or the housing bubble building. Its that they thought it didn’t matter. The phrase commonly thrown around was “the Fed doesn’t target asset prices.”

That’s a more convoluted way of saying, this business with housing and mortgages may be a house of cards, but “so what?”

I don’t want to sound like I am pointing fingers here. I was deeply sympathetic to that view. Sufficiently powerful monetary policy I thought, and honestly still believe, could offset virtually any shock.

What we wasn’t appreciated fully enough was the fact that monetary policy would not be powerful enough; that central bankers are only human and that they will be hesitant to take extreme action.

In the light of those limitations it becomes more important to manage precarious situations as they arise. However, from the point of view of understanding the economy we also need to note, as Matt Yglesias reminds us to do, what powerful monetary policy can indeed accomplish.

I had been urging the Fed to effectively “go negative” by promising inflation. In Sweden, the central bank went literally negative.

For a world first, the announcement came with remarkably little fanfare.

But last month, the Swedish Riksbank entered uncharted territory when it became the world’s first central bank to introduce negative interest rates on bank deposits.

Even at the deepest point of Japan’s financial crisis, the country’s central bank shied away from such a measure, which is designed to encourage commercial banks to boost lending.

The result was a surging Swedish economy. Indeed, as the FT reports, the fastest growth on record. This is coming out of a worldwide economic collapse.

This is also despite a long-run price to income profile that’s not that far off from the United States and peaked around the same time

I don’t think Krugman is doing this, but it is easy to get too caught up in thinking the macroeconomy is an extension personal finance. Having bought a house you couldn’t afford seems like a really bad situation to be in, and if everyone is in that situation then it seems like that ought to be really bad for the economy.

However, keep always in the front of your mind that a recession is not simply a series of unfortunate events. A recession is when the economy produces less. For example, the AIDS epidemic in Botswana is a horrible event for millions of people that uprooted lives and destroyed families and promises to leave a generation of orphans.

However, Botswana’s GDP growth didn’t turn negative until Lehman Brothers went under.

That a Global Financial Crisis could do what rampant death and disease could not, is an important indicator of the nature of recession.

A recession isn’t when bad things happen, whether that’s loosing your house to foreclosure or your parents to AIDS. A recession is when the economy produces less.

Somehow you have to make a link between the bad thing happening and the economy producing less. I maintain that, that link almost always runs through the supply of money and credit.

I posted a link to Bryan Caplan’s paper on Behavioral Economics and the Welfare State. Many of the comments I got from economists were predictable:

- Where is the formal model and existence proofs?

- Where is the data analysis?

- How is this a paper?

- Do you mean to tell me this is publishable?

I too was shocked initially by these features or lack thereof. However, that’s part of what made the paper compelling.

Some papers get a wonderful data set, perform magnificent identification and get a result that really changes your mind about something you care about. Most don’t.

Most are cases that are of very narrow interest or do a 90% good job at the ID but leave enough doors open that you are not really sure if the result is meaningful or not.

On the other hand, one could as Bryan and his co-author did, attack an important question, string together some non-obvious points and in my case leave the reader thinking about whether he or she should reexamine an import view.

The profession should rightly celebrate the first kind of paper. However, what about the relative worth of the second and the third?

I submit that bringing up arguments that use the economic way of thinking matter. This is true even if the argument is not definitive, has no mathematical proof behind it and marshals no data.

Let me give a more timely example. We are now engaged in a debate over the nature of recessions and how the government should respond. There are obviously lots of models and empirical studies, none of them perfect.

However, more than any other analysis the baby-sitting coop story made me a confident Keynesian. Before then I could parrot the New Keynesian models and understood that this was more or less what a smart economist was supposed to say.

However, I didn’t know how to counter the logic of Laizze Faire except to say, “well there are sticky prices and an Euler equation and so the household will adjust consumption . . . “ This is compelling to virtually no one – not even, on a deep level, to myself.

When it really came down to it, I would have been left with “Great Depression! Want it to happen again? No? Then we need to spend more money or cut taxes! Why? Because I am very smart and I have a whiteboard. Do you have a whiteboard?”

However, a simple story about baby-sitting and it all fell into place. Paul Krugman has retold the story many times. Its about a baby-sitting co-op that uses scrip to track how many times a couple has sat for other members of the co-op and thus how many times someone should sit for them.

Because of some mismanagement in the handling of scrip the co-op at one point went into recession. There weren’t any fewer people who could babysit and there weren’t any fewer opportunities for couples to go out. The real baby-sitting economy hadn’t changed.

Bad policies by the co-op leaders reduced the number of scrip per couple. And, for lack of scrip no one went out. And because no one went out, no one sat. And because no one sat, no one got any scrip. And, since no one got any scrip, no one could go out . . .

Excess demand for financial assets led to a collapse in the demand for real good and services. Something that seemed extremely complicated was elucidated by a simple story.

Years ago that story was printed in an economics journal. I read it in the Slate.com archives.

As I have mentioned before I started warning of a Japanese style scenario in early 2008, not because of a formal model, but because of that baby-sitting story.

You see, the investment banks were like a baby-sitting couple who by borrowing and lending script and carefully tracking dining out patterns with fancy computer models had assured everyone that any couple, at any time, could find a baby-sitter whether they had physical scrip or not. Just come to us, and we’ll make it happen. No scrip down as it were.

That system was about to collapse and when that happened the demand for physical scrip was going to skyrocket. If you believed the original baby-sitting story that meant a recession of epic proportions. We were going to need a lot more scrip and the Fed didn’t seem to get that.

Nor, I should mention, did may people familiar with mainstream macro-economics. Its not that you couldn’t have gotten that result out of the math models. Its that you wouldn’t have known where to look.

You would have thought about wealth effects and the distributional impact of housing. Willem Buiter, a very smart man, insisted there would be no recession because the decline in the price of houses made homeowners poorer but homebuyers richer. This does somewhere between little and nothing to the representative agents Euler equation. However, Buiter failed to consider the simple lesson of the baby-sitting economy.

Buiter, forgot about scrip.

Krugman blogs on demand-deniers, those who don’t believe that recessions are caused by a fall in Aggregate Demand.

Third, monetarists — old-style Friedman-type monetarists who focus on monetary aggregates, or the new style which says that the Fed can and should target nominal GDP — are, whether they realize it or not, part of the axis of monetary evil as far as the demand-deniers are concerned. They may believe that they can limit the scope of demand-side reasoning, making it a case for technocratic policy at the central bank but no more than that. But from the point of view of those who can’t see how demand can possibly matter, they’re essentially in the same camp as Keynesians. And you know, they are; once you’ve accepted the idea that inadequate demand is the problem, the role of fiscal as opposed to monetary policy is just a technical detail (albeit one of enormous practical importance).

At first I thought he meant those who focus on monetary policy were inadvertently pumping up the demand-deniers. A re-reading revealed that he meant that the monetarist were on the same side as Krugman – and thus evil in the minds of the demand-deniers.

In a recent email to a fellow economist, I pointed out that as soon as you accept that the Federal Reserve has control over the overnight interest rate almost all of the Aggregate Demand conclusions fall out as a matter of basic intertemporal optimization.

Said more explicitly:

If the Fed tries to increase interest rates by shrinking the money supply then folks will try to buy less and save more.

If the market functions smoothly and perfectly then buying less will drive prices down. Saving more will drive the interest rate back down and almost everything will go back to the way it was before the Fed did anything. The only difference will be lower prices.

Thus the Feds effort to raise interest rates would fail.

For the Fed to even be able to alter interest rates there has to be some frictions in the market.

Now you might think that the distortions involved in monkeying with the money supply are so bad is not worth it, but you are in the technocratic world now. You are debating the merits of various demand side policies – not whether or not they are logically possible.

More or less the same thing is true with deficit spending as well. You could believe that deficit spending today causes people to save more in anticipation of higher taxes tomorrow but it takes some pretty heroic assumptions to get all the way to the idea that deficits can’t possibly spur demand.

At the root, I agree, is the common tendency to deny that something is possible when what you mean is that it is undesirable. You might have a laundry list of reasons to think that deficit financed Aggregate Demand expansions are undesirable but that is different than saying that they are impossible.

Denialism, to be clear, does not market one as a crank or fool. Almost everyone does it. I have heard many people claim that violent crime, prostitution, drug abuse, etc could not be eliminated even if we removed all restraints on the state.

I’ve also heard people say that poverty could not be eliminated with a likewise abandonment of our basic principles of government.

All of these denials are almost certainly wrong.

I am tempted to describe the policies that I am confident would virtually eliminate crime and poverty but their draconian nature is so extreme that the description would cause people to recoil from my general case. Moreover, I adamantly profess that doing these things would make the world a much, much worse place.

And, that’s the point. If you don’t like deficits then you can and shouldmake the case that the ultimate price is too high. You should feel free even to make the moral case that these things shouldn’t be done even if they would improve the economy.

However, what we shouldn’t do is look away from the truth because the weighing of right and wrong is too painful.

Paul Krugman is at it again with his calls, using a model based on what I believe to be an entirely flawed conception of monetary policy at the zero bound, to argue that China’s currency policy is harming the US:

So again, the Fed is moving in the right direction, both for US interests and for the sake of the world as a whole. China is beggaring its neighbors, which in this case means everyone else.

Krugman is continuing his call that we begin threatening to engage in protectionism through legislation aimed at Chinese products. Of course, this is wholly unnecessary. Matt Yglesias has the money quote:

The Chinese government’s discomfort with monetary stimulus is understandable. Monetary stimulus plus Chinese currency policy will equal an undesirably large amount of inflation in China. That means that in order to avoid an undesirably large amount of inflation, Chinese leaders will need to engage in a more rapid currency readjustment than they want to. That, however, merely underscores that unilateral monetary action is the right way for the US government to handle our concerns about China’s currency policy. We don’t need to threaten them, or bribe them, or cajole them, or go to “currency war” or anything. What we need to do is to adopt monetary policies that are appropriate for our economic situation. The Chinese will learn to deal with it, and in the longer term we’ll all be better off.

Which highlights the idea that beggar-thy-neighbor policies are anything but zero-sum games when it comes to money. All currencies can’t devalue against each other simultaneously, but all currencies can depreciate relative to goods and services…and that has a stimulative effect. Depending on the relative slope of your economy’s SRAS curve that either means higher inflation or higher real output. Monetary easing in the United States would likely mean higher real output in the US…but it would likely mean higher inflation in China.

What exactly does that do? It gives China cover to adjust their exchange rate policy. A policy of easy money in the US actually benefits both the US and China (assuming that China will follow an optimal policy regime).

What is embarrassing is that we live in a rich country, with a fiat currency, and we are still having a conversation about how to get the economy off the ground…and furthermore contemplating highly detrimental policies in order to do so.

In a blog post today, Paul Krugman outlines a hypothetical situation that we could find ourselves in:

And this raises the specter what I think of as the price stability trap: suppose that it’s early 2012, the US unemployment rate is around 10 percent, and core inflation is running at 0.3 percent. The Fed should be moving heaven and earth to do something about the economy — but what you see instead is many people at the Fed, especially at the regional banks, saying “Look, we don’t have actual deflation, or anyway not much, so we’re achieving price stability. What’s the problem?”

I wonder if, on a particularly lazy day when Paul Krugman finds it difficult walk upstairs, he claims that he is in the “main floor trap”? But I digress. There is only one culprit in this situation: the dual mandate.

I’m not an expert on the history of the dual mandate, but I would venture a guess that it was the result of a grand bargain in which “price stability” came from the “hawkish” right, and “unemployment” came from the “dovish” left. The nature of the Fed’s dual mandate is such that it allows the central bank to wiggle out of nearly any situation if finds itself in with little consequence. Since the Fed is aiming at two diametrically opposed targets at once (price stability and full employment), it has large discretion upon which it can draw to justify its policy actions.

Is unemployment 9.5% with core CPI inflation falling below 1% and future expected inflation well below target as well? Well, that’s price stability!

How about persistent inflation rates bordering on double-digits while employment booms? Pat yourselves on the back guys!

In reality, and much to the chagrin of leftists everywhere, the modern Fed (1980’s+) has mostly erred on the side of price stability, which in the recent context has meant 5% NGDP growth with a rough average of 3% real growth and 2% inflation. This has allowed for a NAIRU of around 4-5% for the United States as a whole. Of course, that is a rate…and as long as the unemployed are continually in flux — that is, as long as hires outpaces quits and fires — that rate isn’t much of a problem. What is a problem is that the same dual mandate that was praised by some economists during the Great Moderation is now enabling the Fed to shirk its duties (and perhaps even worse, providing cover for “leveling down” with an implicit policy of opportunistic deflation…which is what Krugman implies above).

The Federal Reserve’s mandate is unique in the world. Most other central banks operate under a “hierarchical mandate” which generally stipulates an inflation target. It is hierarchical, because the central bank can set any target other targets it wants, and pursue them in order as long as they have hit their mandated target. The results of this kind of target vary from country to country.

In my opinion, Congress should scrap the Fed’s dual mandate, and instead mandate that the Federal Reserve set an explicit nominal target, and do everything in their power to hit that target (level targeting). If they’re feeling generous, they can give the Fed discretion as to which target they would like to set. If not, I would specify NGDP. I don’t think that the monetary policymaking body of the Federal Reserve should even look at a single unemployment number. They should focus like a laser on their keeping their nominal target in a very narrow range and leave the question of unemployment (which is a real variable) to other policymakers.

Stabilize monetary policy around a nominal aggregate, and I would wager that unemployment would find a way to work itself out with minimal intervention.

P.S. I kind of smile when I think about the Fed “moving heaven and earth to do something about the economy”. I suppose that is because 1) I think that monetary policy can do so and 2) I’m a huge nerd.