I saw a good bit of commentary suggesting that the contribution of Residential Investment to GDP was surprising. On the whole I am surprised that it is not higher, though going into the GDP report I knew I had not seen the level of Multifamily starts I had been expecting.

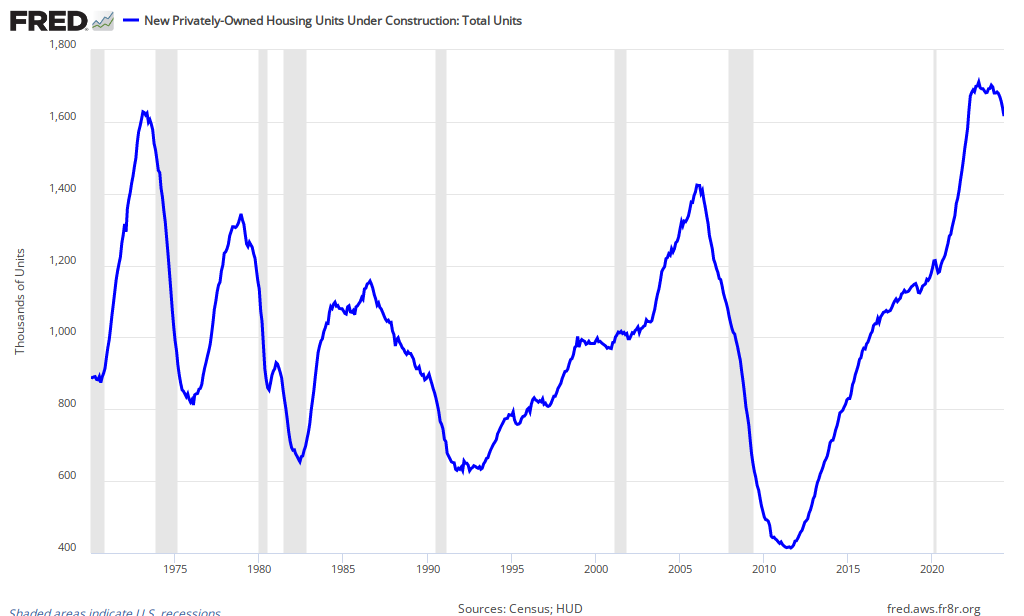

Nonetheless, one of the important things to remember is that it takes time to build houses, and multifamily in particular takes a long time. When we look the number of total units under construction we see this

Which looks like a small and pathetic recovery. However, what matters for GDP is not level but absolute change.

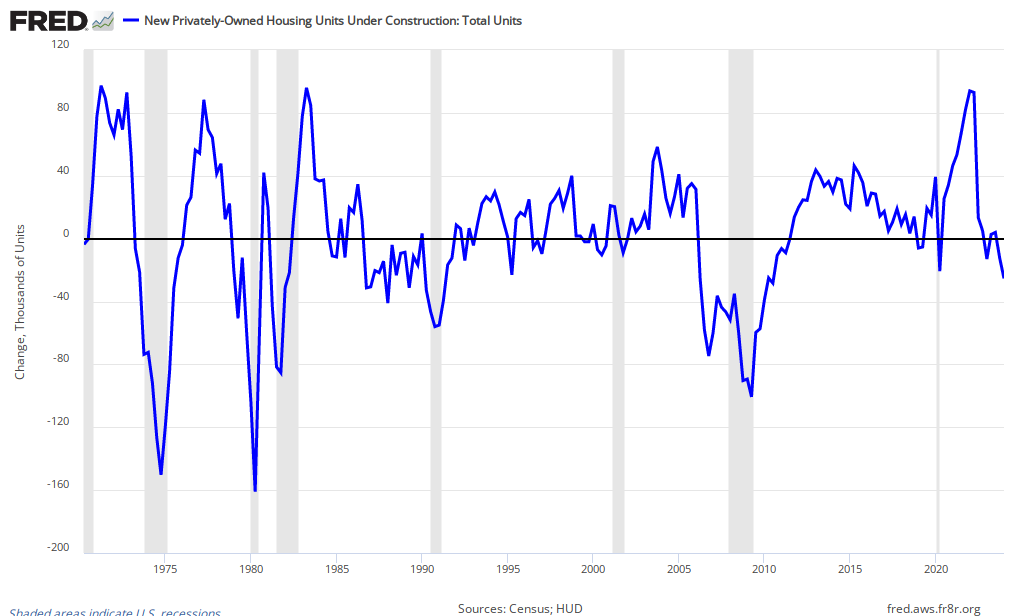

So here is the quarterly change in units under construction.

This shows an absolute change at roughly half of levels seen during the later half of the boom. Given the sharp rise in permits I suspect the number of units under construction will grow at an increasing pace suggesting that we could soon have GDP contribution nearing levels seen during the boom.

1 comment

Comments feed for this article

Wednesday ~ May 2nd, 2012 at 5:22 pm

FT Alphaville » The Closer

[…] – Waiting for house-building’s comeback in US GDP. […]