In all likelihood no one reading Rajan’s essay was a impacted by his casual dismissives regarding residential construction as I was. This has been a point of mine for over a year now but let me make a few comments because they are still relevant to how people think about the world.

Rajan wrote:

The status quo ante is not a good place to return to because bloated finance, residential construction, and government sectors need to shrink, and workers need to move to more productive work.

There are three ways you could take this – all of them I think misguided.

- The residential construction sector is currently bloated and needs to shrink

- At the onset of the financial crisis the residential construction sector was bloated and needed to shrink.

- At its peak the residential construction sector was bloated and needed to shrink.

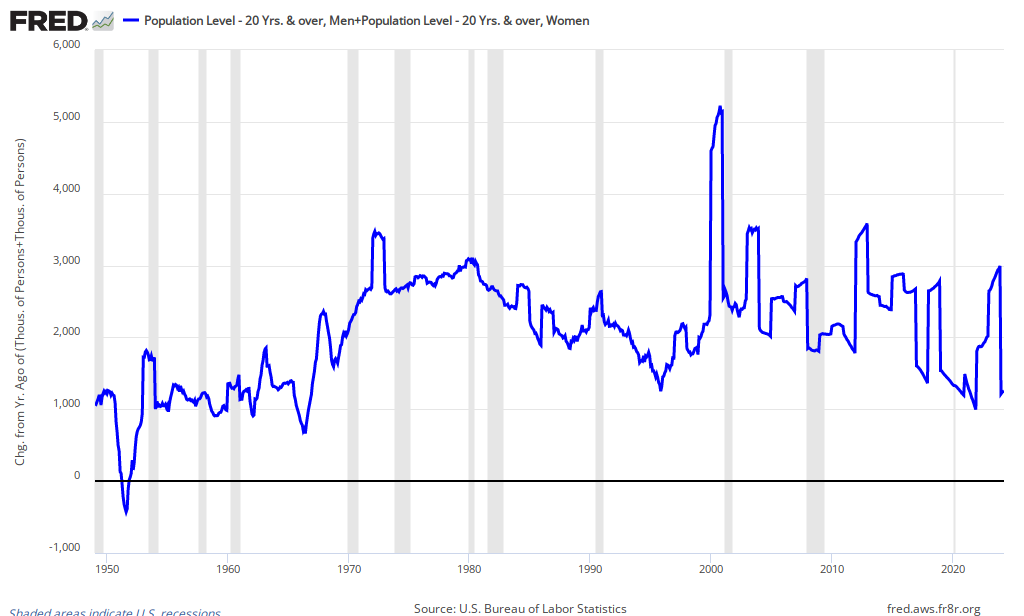

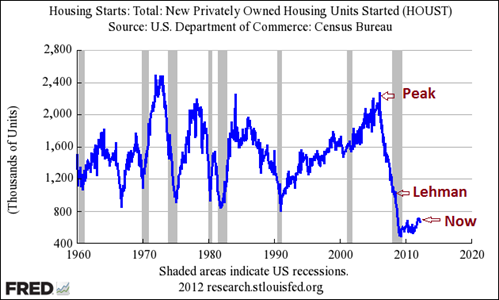

Here is a chart of housing starts since 1960. Some folks like to use Residential Fixed Investment as a percentage of GDP. However, there are at least two issues with this. One RFI is not the same as construction. Real Estate brokers are a part of RFI for example and they experienced a significant boom during the 2000s related to the home buying increase. A distinction I will make more of later. Two, RFI as a percentage of GDP will rise when the some other part of GDP falls but this does not necessarily imply that all of GDP should fall.

So, lets look at starts which are a proxy for construction itself

I think it’s a fairly straight forward case that the current level of housing starts is well below what is likely to be the long run average for the United States and indeed is currently falling behind household formation, which itself is falling behind population growth. This is reflected in rapidly declining rental vacancies and rapidly increasing rents.

What may be more surprising to folks is how depressed residential construction was going into the financial crisis. As Lehman Brothers declared bankruptcy, housing starts were already nearing record lows and were well behind population growth.

Indeed, the majority of the fall in starts happened even before the US entered recession. By the time the recession began housing construction was close to what some analysts at the time thought would be the cycle low. I disagreed, of course, but I do remember this was a major point of contention. There were not unintelligent folks suggesting in 2008 that home construction had bottomed.

Had the US remained at the construction level it had at the beginning of the recession it would not have been able to keep up with population growth especially given what had been a healthy influx of Mexican immigrants. Recently, the influx has died off and housing demand is actually weaker than we would have expected.

However, if the recession and immigration crackdowns had not come we would have been well below trend even at the dawn of the recession.

Now, what about the peak. Surely it wasn’t sustainable?

A few things though

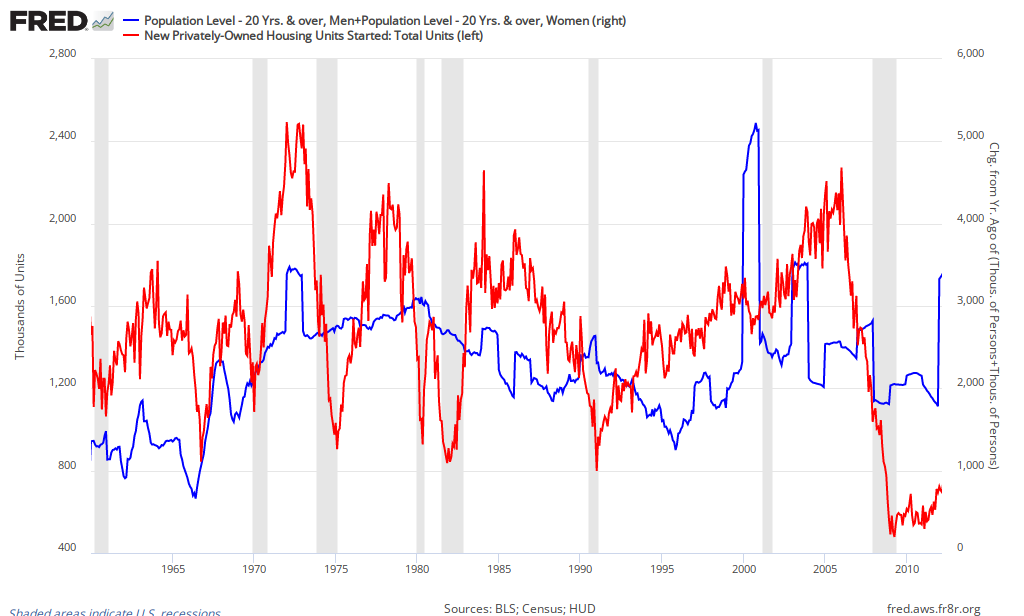

First, it wasn’t even the all time peak. Starts in the 1970s were more robust as the baby boom generation was leaving the nest. And in the 2000s with the Eco-Boomers and Mexican immigration we were facing an adult population surge greater than that seen with the baby boom.

Here is the year-over-year absolute change in men and women over the age of 20. You can see the baby boom generation come of age in the 70s and you can also see the recent spikes, in part due to updates in the count of immigrants.

Now, lets layer this over starts

Given the relative changes in the adult population the surge in starts is not way out of line. Indeed, its not clear that it is out of line at all.

It may be that given the rapid drop off in immigration that we saw in the last half of the the 2000s that the huge ramp up in housing starts was ill-conceived. However, in 2004 when starts where surging towards their peak it was not clear that this was going to happen.

Thus, arguing that what was wrong with America is that we went on a crazy homebuilding binge is not clearly supported by the data. It is clear that we went on a crazy home buying binge and the number of rentals in the US collapsed. However, that is not the same as homebuilding.

Rental construction is residential construction and I am particularly sensitive to folks acting like the only residential construction in the world is detached single family homes. There is an important market in rentals and its not at all clear that once this market is taken into account that America was ever building an unreasonable number of homes.

However, even given all of that the US reduced home construction by over 50% even while the unemployment rate fell from 2005 to 2007. There was no problem at all shifting resources out of residential construction and into other things.

And THIS is precisely my point. People routinely ignore this key fact. The US had absolutely no problem whatsoever rapidly shifting the structure of production out of residential construction.

There was no problem because as this happened the dollar was falling and US Net Exports were surging. Indeed, part of the reason Net Exports had collapsed was because residential construction was surging. There was a smooth rebalance between the sectors and it occurred because PRICES were changing to make it happen.

This is why I simply can’t get over conversations about the recession and the mass increase in joblessness that ignore the key role of prices in shifting patterns of supply and demand.

11 comments

Comments feed for this article

Thursday ~ May 10th, 2012 at 4:50 am

reason

Karl,

super!

Thursday ~ May 10th, 2012 at 6:37 am

Noah Something

Immigration ended because the jobs ended.

This is what Mexican immigrant told me — their friends and family were going back to Mexico because of job market.

I counted well over 100 day laboreres at one Home Depot several years back.

Wednesday ~ June 6th, 2012 at 3:56 pm

Temanyaat

You should sersluioy think about working on expanding this blog into a major authority in this market. You certainly have a grasp handle of the matters everyone is searching for on this blog anyways and you could surely even make a dollar or two off of some promotion. I would explore following recent topics and raising the amount of write ups you put up and I guarantee you’d begin seeing some awesome traffic in the near future. Just a thought, good luck in whatever you do!

Thursday ~ May 10th, 2012 at 6:44 am

Noah Something

A large percent of new immigrants in California didn’t have 8th grade educations, and a large percentage of the children of immigrants in California were high school drop outs.

Their marginal productivity as laborers didn’t give them the salary to make payments on their mortgages on high priced California housing.

Famously, dozens of people and often multiple families routinely lived in a single house.

Thursday ~ May 10th, 2012 at 6:45 am

J.V. Dubois

Perfect and very well thought-off analysis. What about other Rajan’s claims:

“. In 2001, in response to the dot-com bust, the Fed cut short-term interest

rates to the bone … ”

No sorry, low interest rates are not sing of easy and accomodative monetary policy: http://www.themoneyillusion.com/?p=13302

“U.S. leaders encouraged the financial sector to lend more to households, especially lower-middleclass ones. In 1992, Congress passed the Federal Housing Enterprises Financial Safety and Soundness Act, partly to gain more control over Fannie Mae and Freddie Mac”

Krugman (and others) wrote like million articles about how wrong is the story that it was government and Freddie&Fannie that fueled subprime crisis. Just one example here: http://krugman.blogs.nytimes.com/2011/07/14/fannie-freddie-phooey/

“Fiscally conservative Germany, for example, reduced unemployment benefits even while reducing worker protections.”

Really? Fiscally responsible Germany who started the crisis with about 80% of GDP? The Germany who invented “Kurzarbeit” – a government subsidy so that companies do not fire workers? “Fiscally responsible” countrie that somehow never tasted its own medicine of fiscal austerity: http://krugman.blogs.nytimes.com/2012/05/01/coordinated-austerity/ or internal devaluation: http://krugman.blogs.nytimes.com/2012/05/06/german-adjustment/

I could go on. But it seems that almost any fact that Rajan states and that can be at least remotely verified is either wrong or highly dubious.

Thursday ~ May 10th, 2012 at 9:36 am

Becky Hargrove

Apartments are definitely what is needed for cities in which there are too few housing options for those who want to live there. Even so, the more desired cities of the U.S. will continue to fight against making room for more citizens, and not everyone wants to move to a hot south in which cars are so often necessary. Because so many people are being blocked from where they would like to go, new, more affordable communities will spring up with zoning that allows for simpler, perhaps less consumer oriented lifestyles. Plus, much higher densities can still be achieved with modular units that take far less space than traditional housing and allow for small scale ownership that helps low income. Overbuilt housing was not the cause of our problems, just another sympton. Large houses were a product that too many people neither really needed or wanted for their lifestyle.

Thursday ~ May 10th, 2012 at 10:47 am

No, Most of the US Did Not Overbuild Housing

[…] Karl Smith: […]

Thursday ~ May 10th, 2012 at 11:39 am

Lord

I agree but considering house construction takes nine months to a year and commitments and planning can take another, a two year lag between starts and employment does not seem long.

Friday ~ May 11th, 2012 at 4:01 am

FT Alphaville » Breaking down five million job losses, and the curious case of construction

[…] Smith makes an important distinction that doesn’t get emphasised enough. The housing bubble of the late 90s through the middle of […]

Friday ~ May 25th, 2012 at 2:22 pm

FT Alphaville » More on auto-driven growth

[…] recently we discussed Karl’s point that too many people are under the impression that there was rampant over-construction prior to the […]

Wednesday ~ October 17th, 2012 at 12:41 pm

Assorted thoughts on Altman and the coming (?) US housing boom | FT Alphaville

[…] One is that, as Matt Yglesias writes today and Karl Smith earlier, the housing boom of the 2000s wasn’t nearly as big as many people think. Or rather […]