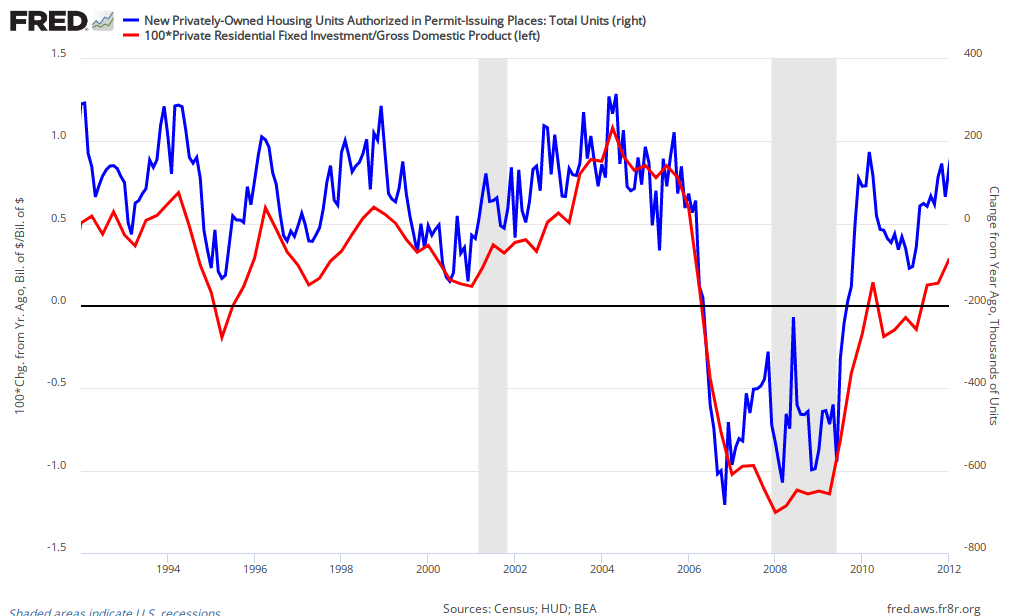

Charted below is the relationship between housing permits and the contribution of Residential Investment to GDP up through the end of last year.

The relationship is perfect, in part because there are more things than new construction in Residential Investment – the Realty industry, home improvements, renovations, etc – but the relationship is nonetheless pronounced.

If permits continue on their current trajectory of roughly 30% Y-o-Y growth it would not be unrealistic to expect a direct contribution to GDP growth of in excess of 1 percentage point. We’ve just spent a little over a year or so with residential construction making no contribution so as a baseline you could think of it as the GDP over the last 18 months plus 1 point.

Presumably, however, there is some multiplier here so you could imagine adding perhaps 1.5 points to GDP. If you also imagine removing the reduction from the drag of state and local government we could get up to 2 additional points. This would take year-over-year real GDP growth from something like 2% to something like 4%.

Now, all of this is subject to the Sumner Critique. That is, we are assuming that the Fed does not have a firm implicit Nominal GDP target. If the Fed does have such a target then it will slow the growth of the economy and prevent this from happening.

4 comments

Comments feed for this article

Wednesday ~ May 16th, 2012 at 12:43 pm

Wednesday links: Euro anxiety | Abnormal Returns

[…] What contribution might housing make to GDP? (Modeled Behavior) […]

Wednesday ~ May 16th, 2012 at 2:57 pm

Ed Ambrose

Housing prices recovered a year ago, measured by the FHFA (Federal Housing Finance Administration), but prices in Case Shiller cities are still falling. The Case Shiller 20 city index is reasonably accurate, but unrepresentative. House prices in these cities are twice the national level.

While the Case Shiller index declined 34% since the peak in 2006, prices outside these regions declined only 13%.

So in the heartland prices are improving but the Case Shiller cites in California and the Northeast (New York and Boston) are falling. The US housing market in recovery will differ sharply by region which is the way it always does. The recovery is good news unless you own property in cities like Los Angeles.

So housing starts are on the path to recovery in places like North Dakota where their is new demand, but not in the cities that were hot in the expansion.

Thursday ~ May 17th, 2012 at 1:15 am

Morgan Warstler

Forget your witty “fed target”

lt’s say “fed frame”

The Fed frame is that things are better when the govt. is serving the interests of business.

We can’t blame free market bankers for believing this in their marrow. That’s how they become fed bankers.

Forget intentionality, ask yourself if the Obama wakes every morning to go fishing for TRULY happy businessmen or if he looks at conventional pro-business “Bush” policy as a pile of shit he doesn’t want to eat.

Who cares what Obama wants to eat? Seriously, who cares what Obama thinks? No one cared what Clinton thought and he preformed like a trained seal.

What matters is whether Obama is fishing for big fish with he right bait.

And we ALL KNOW IT. You might not like it, but even you know it. Own reality Karl.

Grow up.

Wednesday ~ August 24th, 2016 at 4:44 pm

Radhika

It’s very important that we have focus on GDP and all these things because it obviously means a lot and that’s why we got to be very careful and on the toes to gain. I find it extremely easy with broker like OctaFX, as they are all so cool and special with having outstanding features and facilities whether it’s to do with small spreads, high leverage, zero balance protection, swap free account or daily updates, it’s all here making trading easier!