I don’t have anything against Kathleen Madigan and I think her posts do a better job at confronting economic data than the vast majority of what you read from major news outlets. Yet, as much because of that as in spite of it, she often presents idealized examples of garbled economic reasoning.

This post on wages and consumer spending is one them.

The first part links low retail sales to stagnant wages. The problems here are several fold.

Consumers managed a soft 0.1% gain in April retail sales, which suggests consumer spending is contributing only modestly to second-quarter economic growth. (In comparison, household spending accounted for 2.04 percentage points of the 2.2% increase in first-quarter real gross domestic product.)

But any increase in household spending is somewhat a surprise since worker buying power is falling far behind the rise in inflation.

True, inflation was flat last month thanks to a 2.6% plunge in gasoline prices. But hourly pay and hours worked also flat-lined, meaning real weekly pay was unchanged in April. Since peaking in October 2010, real pay has declined by 1.2%.

To be sure, personal income is made up of more than just paychecks, but wages and salaries still account for the bulk of income totals and are more likely to be spent than items like dividends.

Obviously there is no particular reason to think that month-to-month changes in wage and retail sales series are going to match but lets set that aside, assuming its just a device to motivate the larger discussion of stagnant incomes and consumer purchases.

A larger issue is that the retail sales series is an aggregate nominal series where Madigan appears to be comparing it to average real weekly earnings and then drawing conclusions about real Personal Consumption Expenditures.

Why does this matter?

Well, if more workers are hired and if their nominal wages are at least steady then we should expect the base for retail expenditures to be expanding even if average real wages are falling. This is because total spending on payrolls is rising even as average real wages are falling. Indeed, this is the classic mechanism by which we explain how recessions come to an end.

We might dispute whether this mechanism is indeed the driver of all recoveries but at minimum it’s the classic driver. Real wages fall and this induces companies to increase total employment and expenditure on payrolls which in turn in induces an increase in total expenditure on consumer goods which in turn induces a further increase in total expenditure on payrolls.

Now, on to immaculate inflation

In one sense, the Federal Reserve‘s quantitative easing may have helped investors, but it backfired on workers.

Steve Blitz, chief economist at ITG Investment Research, makes the point that in an open global economy the Fed has managed to raise inflation through its QE programs, but not wages. “As a consequence, consumer growth softens rather than accelerates,” he says.

The key here is to ask what exactly this is supposed to mean. So the Fed induces inflation through some means but this means winds up reducing consumer growth?

Its actually not that this is impossible. We could imagine, for example, that the Fed action is causing the dollar to fall. However, we need to trace through some mechanism. Generally prices go up when people are trying to buy more stuff. So, when you say pricing are going up, so people are buying less stuff, then off-the-cuff red flags should go up.

What exactly is it that you are saying here?

Moving on

Blitz cites two reasons for wages’ nonresponse.

First, there is still a huge surplus of labor. Second, firms that are growing are competing globally, either through export or import substitution, and as such, “wages must be internationally competitive on a total productivity basis.”

Real manufacturing wages are especially under pressure since U.S. factory workers are competing with workers in emerging markets.

This seems to suggest something like a falling real exchange rate / falling real wage story. This of course is precisely our story about recovery, increases in payrolls and ultimately increases in PCE. So, we want to be explicit about how this ties back to the original insinuation of falling PCE.

Lastly,

The weakness in real pay may explain why consumers are pulling out their credit cards again after years of deleveraging. According to Fed data, revolving debt that includes credit cards jumped in March.

. . .

The Great Recession showed that U.S. consumers cannot permanently finance their lifestyle on credit. The economy is going to have to generate more jobs and pay raises above inflation to ensure the consumer sector contributes its share to the recovery

The first paragraph hints at a common theme missed by market analysts when they talk about “the consumer” I see folks do charts of real per capita disposable income as the “health” of the consumer. Its not entirely clear what that is supposed to mean, but what it almost certainly does not indicate is real purchasing power available for retail goods and services.

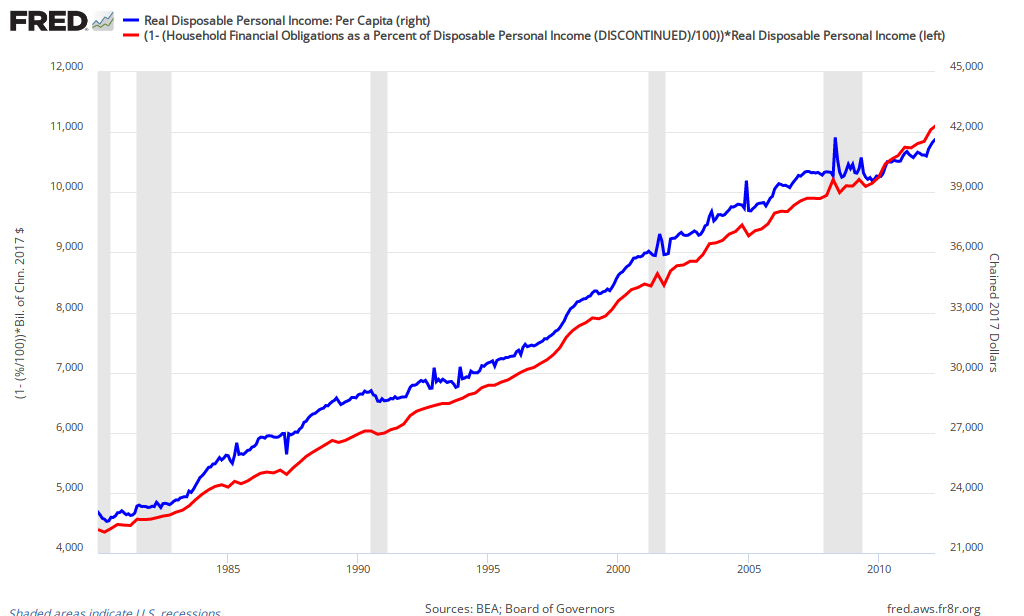

Here for example, is real per capita disposable income compared to real total disposable income after financial obligations.

The red line shows growth rather than stagnation for two reasons. First, the population is rising which means that total disposable income can grow even as per capita disposable income stagnates and second household financial obligations are falling dramatically which implies that after paying credit card bills, mortgages, etc folks have more money left over than in the past.

The relevance of the latter should be immediately clear but the former is important as well. Imagine for example, if the economy was adding an average of 170K jobs a month but the population was not growing. In that case the economy would be rapidly converging on full employment.

So that the population is growing is important both for our sense of how the job market is evolving as well as how consumer spending is evolving.

In closing I’ll just mention, as I often do, that it is not clear why the Great Recession showed us anything about consumer borrowing.

Folks are quick to say this but I have yet to see someone lay down a case for why this makes any sense. Just to keep it short I’ll note that the crisis centered around losses to lenders, not losses to borrowers.

1 comment

Comments feed for this article

Wednesday ~ May 16th, 2012 at 9:57 am

curtd59

Karl,

What is the narrative that people need to understand, in order to change from how they think about economic data today, to how you recommend they think about it?

Can you digest that to a theme and tie your posts consistently to that theme?

Anyone who hosts a talk show or major newspaper column, or magazine editorial, has six to ten themes that they repeat, and teach through repeated application. You tend to repeat your criticism. You repeat your policy prescription. But you do not state the general error in reasoning and how to correct it.

I think I know what it is you’re doing differently. (And I also know the limit of it.) But how do you make that one of your talking points? Or do you intuit the difference without being able to articulate it? (I have a had time believing that.)