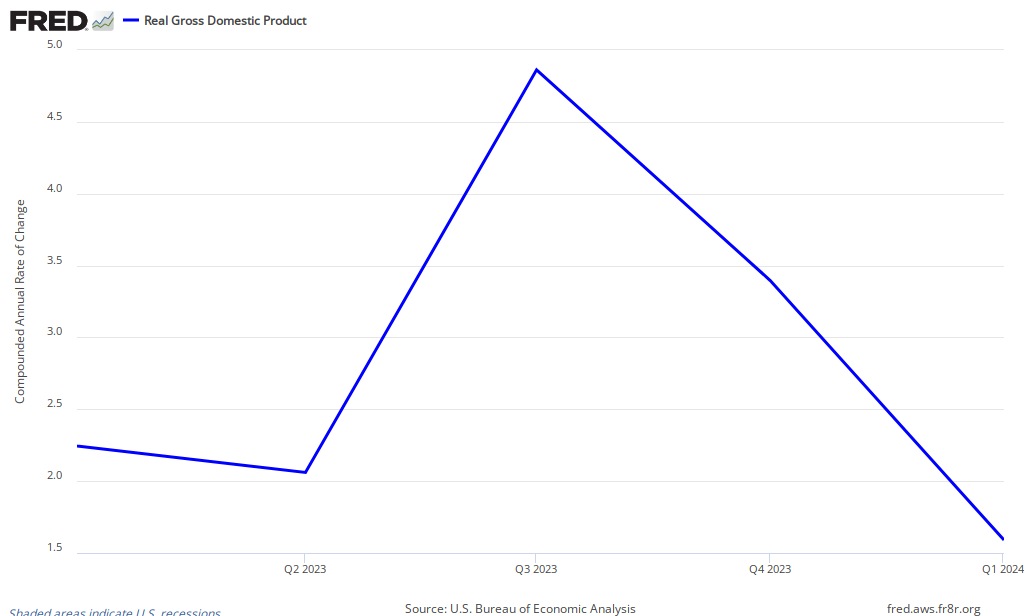

Current official estimates of GDP growth over the last year look like this

My baseline assumption is that this will be edged up both on stronger residential construction and stronger business investment than originally estimated. A revised figure of 3.0% is not out of the question.

This would put Q1 GDP at a more rapid pace that Q4, and create a nice stair step coming out of 2011.

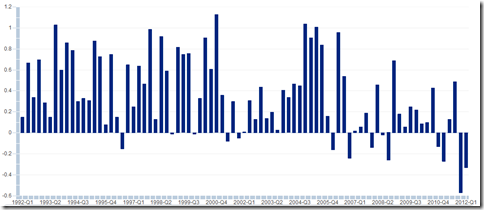

Q2 has just begun but there are major tailwinds moving in. The biggest of course, is utility consumption.

Housing and utility consumption faced major declines over the last two quarters, subtracting just under one percentage point from GDP, as heating consumption collapsed over the winter.

That is likely to bounce back strongly in Q2 if utility use simply returns to normal. This means that we could be starting out with a point or so base on which to build.

Now, as a intellectual matter I tend to discount the importance of the GDP report anyhow, but I do understand that it is the most widely looked at benchmark and so folks will probably be interested in evidence that we are seeing accelerating GDP growth all the way from 2011:Q1 to 2012:Q2.

6 comments

Comments feed for this article

Friday ~ May 18th, 2012 at 8:12 am

rjs

energy consumption as a % of GDP is on the order of 8%, most of that is gasoline…

Friday ~ May 18th, 2012 at 11:42 pm

moe219

I’m a fairly new reader of your blog. Why do you discount the importance of the GDP report?

Saturday ~ May 19th, 2012 at 3:30 pm

News for Saturday May 19th | Full Metal Analyst

[…] Why we should expect to see upward revisions to GDP estimates. (Modeled Behavior) […]

Thursday ~ May 2nd, 2013 at 1:13 pm

Cheap Nike Blazer High Vintage Varsity Purple shoes

I truly appreciate this post. I?|ve been looking all over for this! Thank goodness I found it.

Wednesday ~ July 15th, 2015 at 1:32 pm

Babu

Although I love to read stuff like these, but at the same time I don’t believe in going with assumption completely, it often leads into falls result. I am fairly happy working with OctaFX broker where I never have to worry about what’s going to happen since I always get day to day update of the market and following that leads into great results, so that’s why I am so happy working with them and it allows me to succeed.

Monday ~ November 16th, 2015 at 7:28 pm

Viran

It is really good to have such updates regularly, as I am new in trading and for me to have support like this awesome web site, it makes everything straight forward, so I really want to appreciate the work done by you guys. I trade with OctaFX broker and they too help me with providing incredible daily market news and analysis service for free and it’s pretty accurate as well, so that’s why I love it so much to use it.